🪨 Critical Minerals Down 10%. $355M+ VC Funding.

Impact Capital Markets #127 looks at our Critical Minerals Stock Index, major impact deals, M&A, and upcoming economic releases.

Kamusta 🏝️

📉 Today's Global Economic Update: German inflation data for June, shows a slight decrease to 2.2% year-on-year from 2.4% in May. This moderation keeps the possibility of another rate cut by the European Central Bank in September open despite inflation remaining slightly above target levels.

👥 Deal of the Day: SmartHR, a Japanese HR management platform provider, raised a $140M Series E to accelerate growth.

What's New?

🪨 Critical Minerals. Critical minerals down 10%

💰 Funding. HR management, solar energy, AI security + more

💼 M&A. Health technology and customer success

📅 Economics. US inflation, euro area inflation, balance of trade + more

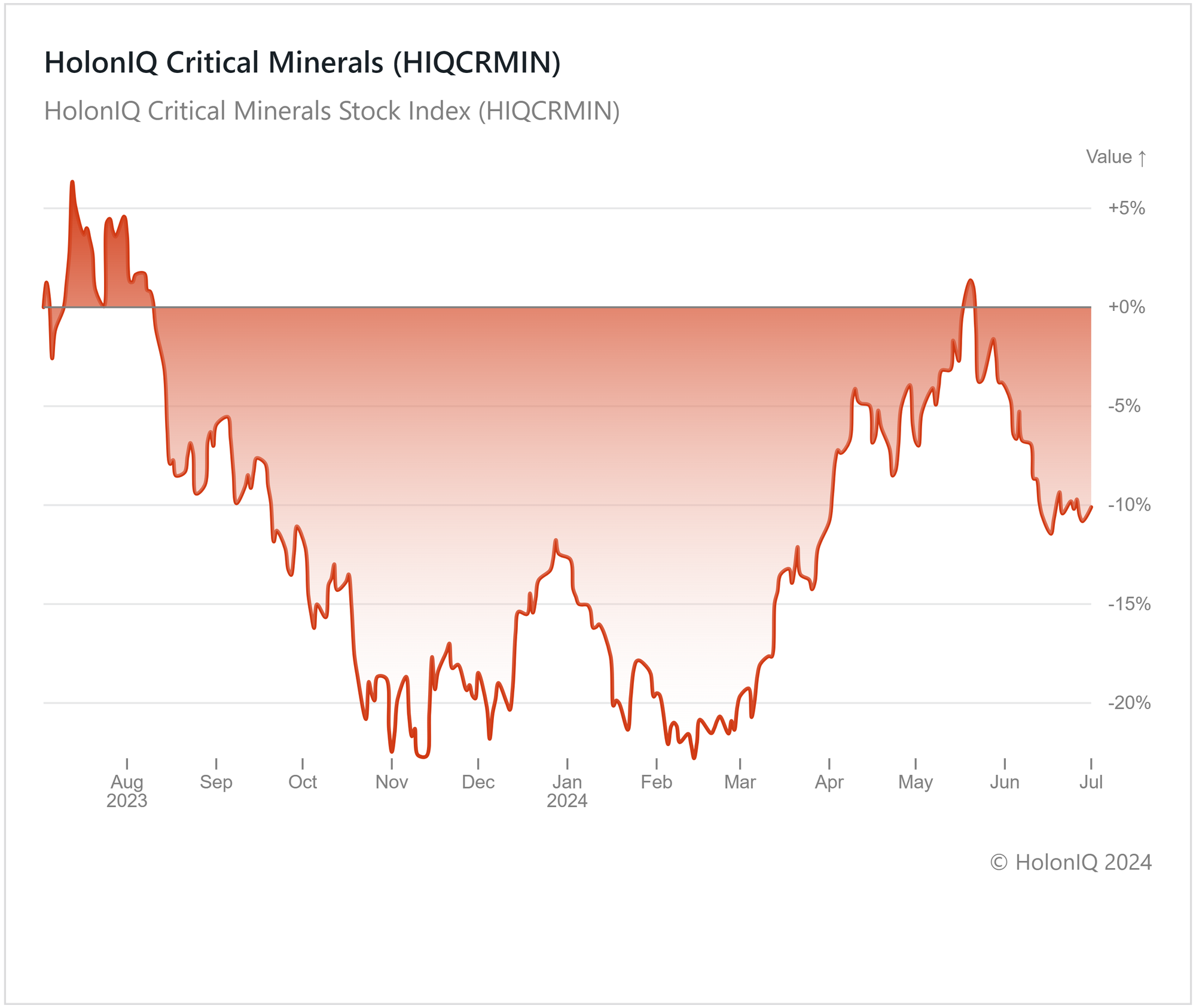

🪨 Critical Minerals Down 10%

The Critical Minerals Index has faced challenges over the past year, initially declining by 10% and hitting a nearly 20% low in mid-February. However, it has since rebounded with a 5% growth in the last 6 months, with the upward trend starting from late March. This recovery is reflected in major index stocks such as Freeport-McMoRan ($69B MCap), Glencore ($4B MCap), and Rio Tinto ($2.6B MCap), which have shown growth of 19%, 4%, and 3% respectively over the past 3 months.

Several factors contributed to the initial decline of the index. Shifts in market demand, including the Chinese electric vehicle market's transition to cobalt-free batteries, significantly impacted critical mineral prices. Policies like Indonesia's ban on raw nickel exports also played a role in shaping market dynamics. Despite these challenges, governments worldwide are increasingly prioritizing the development of sustainable and resilient clean energy supply chains, recognizing the pivotal role of critical minerals. Global initiatives, such as those by the US and the EU, aim to secure critical mineral supply chains. The critical minerals industry is also facing long-term challenges due to environmental impacts and economic sustainability issues. However, recent efforts towards industry transformation, including commitments to higher standards and sustainable practices, could indicate a path to recovery and future resilience through international cooperation and joint investment frameworks.

💰 Funding

👥 SmartHR, a Japanese HR management platform provider, raised a $140M Series E from TOKYO-KKR and Teachers’ Venture Growth (TVG) to accelerate growth.

☀️ Xurya, an Indonesian solar energy startup, raised $55M from Norfund to expand its business and support sustainable energy transition.

🔒 ZeroEyes, a Pennsylvania-based AI security company, raised a $53M Series B from Sorenson Capital for R&D efforts.

🌟 K Health, a New York-based AI primary care platform, raised $50M from Claure Group to scale its operations.

💼 M&A

🩺 Fabric, a New York-based healthcare technology company, acquired MeMD, an Arizona-based provider of virtual care benefits.

🎉 ClientSuccess, a Utah-based provider of a customer success platform, acquired Baton, a New York-based provider of a customer onboarding and implementation platform.

📅 Economic Calendar

US Inflation, Euro Area Inflation, Balance of Trade + More

Tuesday, July 2nd 2024

🇪🇦 Euro Area Inflation Data, June

🇺🇸 US JOLTs Job Openings Data, May

Wednesday, July 3rd 2024

🇨🇦 Canada Balance of Trade, May

🇺🇸 US ISM Services PMI, June

🇦🇺 Australia Balance of Trade, May

Friday, July 5th 2024

🇨🇦 Canada Employment Data, June

🇺🇸 US Employment Data, June

🇨🇦 Canada Ivey PMI s.a, June

Monday, July 8th 2024

🇩🇪 Germany Balance of Trade, May

🇦🇺 Australia Westpac Consumer Confidence Change, July

🇦🇺 Australia WNAB Business Confidence Index, June

Tuesday, July 9th 2024

Thursday, July 11th 2024

🇬🇧 UK GDP Data, May

🇺🇸 US Core Inflation Data, June

🇺🇸 US Inflation Data, June

Friday, July 5th 2024

🇺🇸 US PPI Data, June

🇺🇸 US Michigan Consumer Sentiment (Preliminary), July

🇨🇳 China Balance of Trade, June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com