♻️ Circular Economy Up 35%. $140M Student Transport Funding++

Impact Capital Markets #19 looks at our Circular Economy Stock Index, major impact deals and acquisitions, and the upcoming economic releases.

The Federal Reserve decided to keep interest rates unchanged following its Jan. 30-31 meeting. The Dow Jones Industrial Average responded with a drop of over 300 points, and futures now indicate a 64% likelihood of rates remaining at 5.5% in March.

Today's Topics

- ♻️ Circular Economy. Circular Economy Index Up ~35%

- 💰 Funding. Generate Capital raises $1.5B + Other deals in climate & health

- 💼 Acquisitions. Early Childhood, AI Care Assistant, Pharmaceutical & More

- 📅 Economics. Major Interest Rate Decisions in the next 2 weeks. Euro Area GDP & Inflation Releases + More

For unlimited access to more deals and economic updates, request a demo.

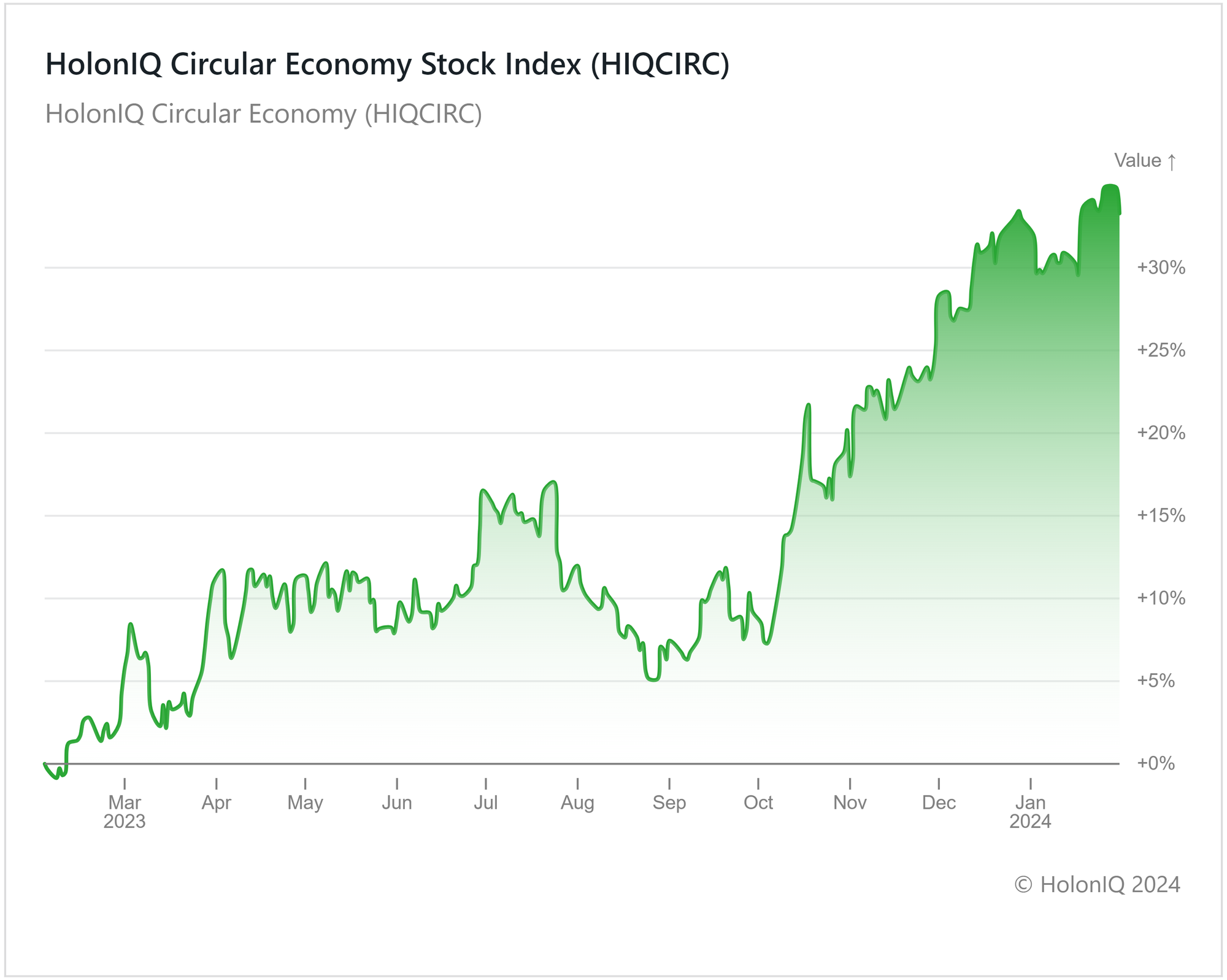

♻️ Circular Economy Up >35% YoY

HolonIQ Circular Economy (HIQCIRC). 12-month Indexed returns (returns on the index relative to the level on February 02, 2023) have been on a general upward trend, increasing to 35% YoY in January 2024.

2023 saw inflation's impact on traditional renewables, redirecting investors towards the circular economy and emphasizing efficient resource use, waste management, and recycling amid rising input costs. The 2023 UN SDG Summit witnessed increased government commitments to managing textile and solid waste and adopting sustainable materials to eradicate poverty, safeguard the planet, and secure prosperity for all. Notably, Eco Lab (Market Cap: US$ 57B) collaborated on a program linking startups with industry leaders, reshaping business operations.

💰 Funding

🌱 Generate Capital, a California-based investment firm focused on sustainability and infrastructure, raised $1.5B in Private Equity from preeminent global institutional investors. The funds will boost General's platform, fast-tracking sustainable power projects, expanding renewable energy, and advancing clean transportation initiatives.

🚐 Zum, a California-based provider of student transportation solutions, raised a $140M Series E from GIC to accelerate the expansion of its AI-driven technology platform.

💊 Halia Therapeutics, a Utah-based clinical-stage biopharmaceutical company, raised a $30M Series C from Todd Pedersen to support the development of Halia's primary product, an innovative inhibitor, currently in Phase II clinical trials.

🏥 Synergy Spine Solutions, a Colorado-based medical device developer, raised a $30M Series A from Amzak Health to complete Synergy's trial enrollment, continue patient follow-up, submit approvals, and support global commercialization.

🔬 AnBogen Therapeutics, a Taiwan-based clinical-stage biotechnology company specializing in groundbreaking cancer drug development, raised a $12.5M Series A from China Development Industrial Bank (CDIB) for the development of Anbogen's two main drug candidates, ABT-101 and ABT-301.

🌍 BlueLayer, a Germany-based company that provides environmental software solutions provider for carbon credit projects, raised $10M Seed from Point Nine to create a comprehensive solution for carbon project developers.

🏥 Myosotis (“myo”), a Germany-based digital healthcare startup, raised a $8.6M Series A from TVM Capital to further grow the business in the DACH region and the UK.

🌱 Xampla, a UK-based natural materials company, raised $7M from Ciech Venture. The funds will be used to extend the Morro consumer brand into new markets and advance the production of eco-friendly, plant-based materials, encouraging a shift away from single-use plastic for major brands.

🐟 Aquaconnect, an Indian full-stack aquaculture startup, raised a $4M Pre-Series B from S2G Ventures to ramp up its operations and expand its footprint nationwide.

💼 Acquisitions

🎓 Avathon Capital, an Illinois-based private equity firm exclusively investing in lower middle-market companies in the education and workforce markets, acquired Magical Beginnings Learning Centers, a Massachusetts-based network of early childhood education centers operating in the Greater Boston Area.

🏥 Fabric, a NYC-based health tech company, acquired Gyant, a California-based conversational AI care assistant and patient engagement suite enabling health organizations to automate patient navigation and scheduling.

💉 Indutrade, a Swedish industrial group, signed an agreement to acquire MeHow Medical Ireland, an Irish manufacturer of injection moulded components and assemblies for the medical device industry.

🔬 ProductLife Group, a Belgium-based R&D advisory firm acquired Commercial Eyes, an Australian pharmaceutical and medical device commercialization consultancy company.

📅 Economic Calendar

Major Interest Rate Decisions, Euro Area GDP & Inflation Releases + More

Thursday February 1st 2024

🇺🇸 US - Fed Press Conference

🇨🇳 Canada - Caixin Manufacturing PMI, January

🇪🇦 Euro Area - Inflation Data, January

🇮🇹 Italy - Inflation Data, January

🇬🇧 UK - BoE Interest Rate Decision

🇺🇸 US - ISM Manufacturing PMI, January

Friday February 2nd 2024

🇺🇸 US - Non Farm Payrolls, January

🇺🇸 US - Employment Data January

Monday February 5th 2024

🇦🇺 Australia - Balance of Trade, December

🇩🇪 Germany - Balance of Trade, December

🇺🇸 US - SM Services PMI, January

Tuesday February 6th 2024

🇦🇺 Australia - RBA Interest Rate Decision

🇨🇦 Canada - Ivey PMI s.a , January

Wednesday February 7th 2024

🇨🇦 Canada - Balance of Trade , December

Thursday February 8th 2024

🇨🇳 China - Inflation Data, January

Friday February 9th 2024

🇨🇦 Canada - Unemployment Data, January

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com