🪨 China's Coal to Plateau by 2025 + Indo-Pacific Climate Tech 100

Despite significant growth in coal consumption over the past five years, China expects to reach a peak by 2025, followed by a decline. This week we also highlight our Indo-Pacific Climate Tech 100

Happy Monday 👋

China's coal consumption is forecast to peak by 2025, following years of growth before a projected decline starts in 2026. Soaring energy demand and grid integration challenges are currently driving this reliance on coal, but this trend is expected to reverse as clean energy capacity catches up. This week, we highlight our Indo-Pacific Climate Tech 100, showcasing the region's most promising start-ups across the energy and storage, food systems, and mobility sectors.

This Week's Topics

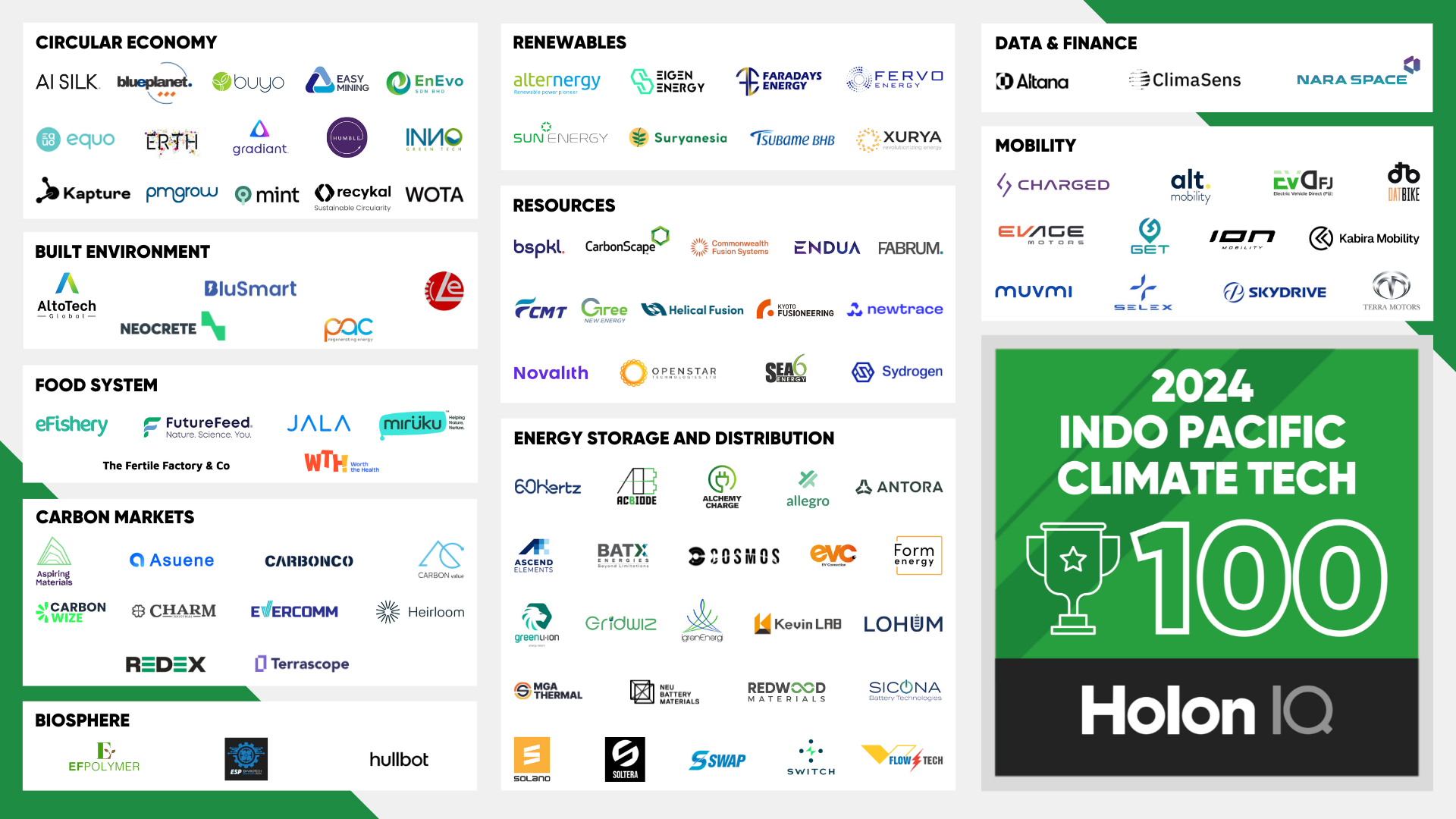

🏆 Indo-Pacific Climate Tech 100. HolonIQ's inaugural list of the most promising Climate Tech start-ups from 14 IPEF partner countries

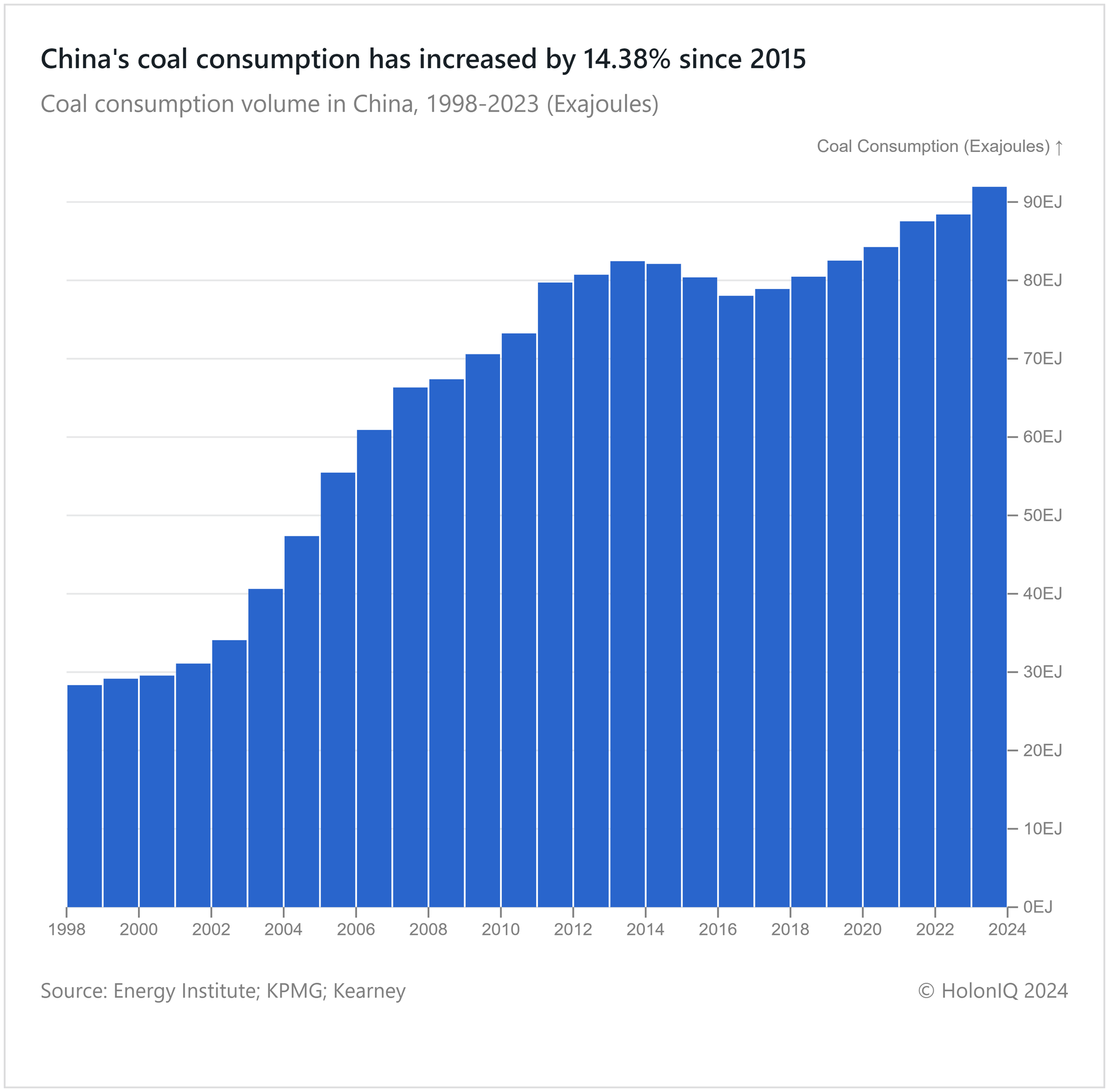

📈 Coal Consumption in China. China's Coal Power Consumption to Plateau by 2025

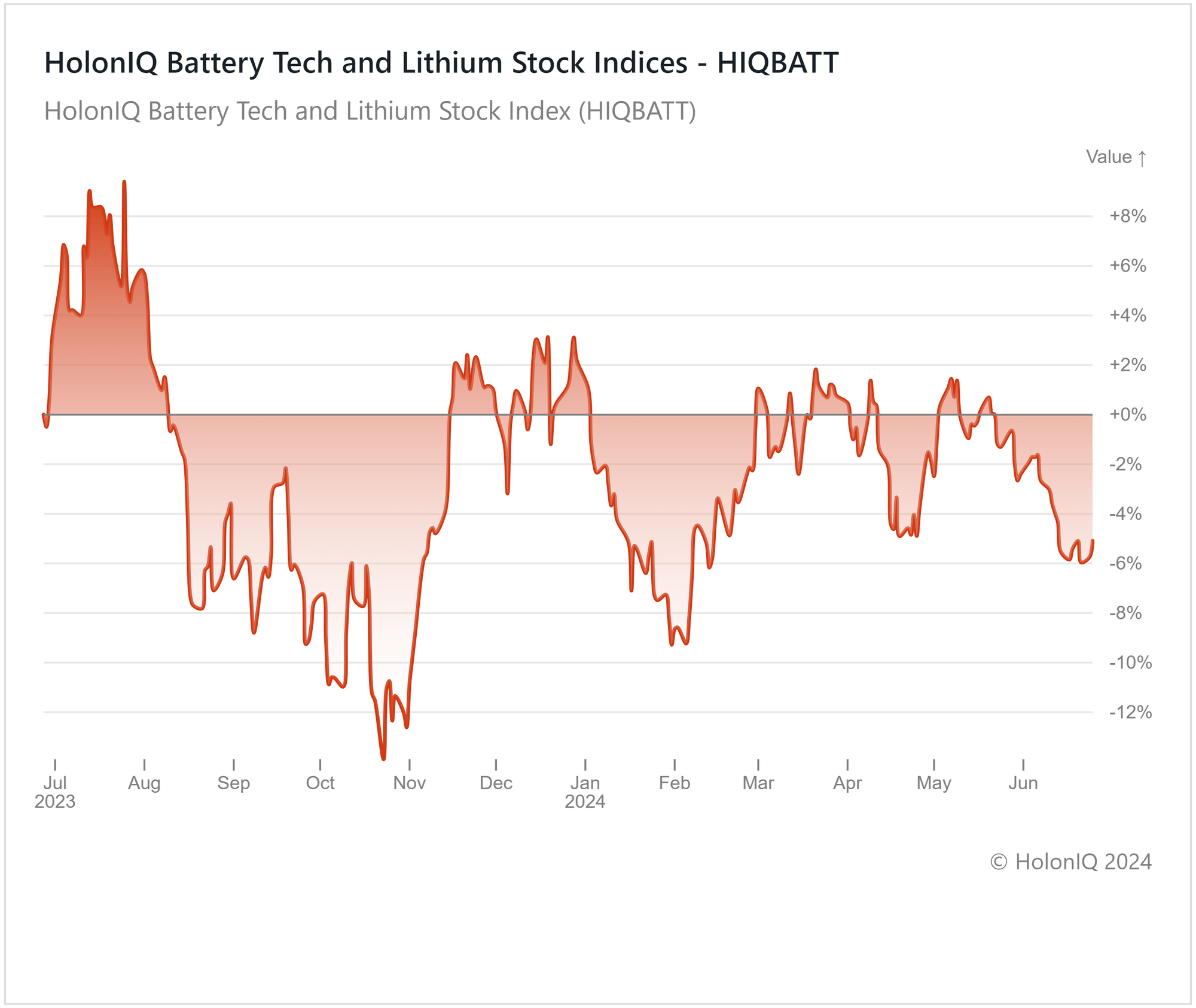

📊 Battery Tech and Lithium Stock Index. Battery tech and lithium stocks are down 5% as global EV demand slows

📝 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🏆 Indo-Pacific Climate Tech 100

The Indo-Pacific Climate Tech 100 includes companies from all 14 IPEF partner countries, representing the region's most innovative and promising climate tech companies. The cohort represents companies with a combined total valuation of over $20B, employing over 12,000 people in green jobs in IPEF economies. The Indo-Pacific Climate Tech 100 cohort attracts total aggregate revenue of $1.5B, growing at more than 20% year over year, and has raised over $12B in total funding to date.

In partnership with the Indo-Pacific Partnership for Prosperity (IP3), this ambitious climate tech initiative is designed to accelerate clean economy investment and climate impact in one of the world's largest and fastest-growing regions, the Indo-Pacific. 50 companies representing the Indo-Pacific Climate Tech 100 traveled from across the 14 IPEF partner countries to meet in person in Singapore last week with over 150 leading investors, philanthropies, and financial institutions seeking to raise $1-2B in fresh funding at the Forum.

📈 China's Coal Power Consumption to Plateau by 2025

China's electricity consumption from coal-fired power plants is expected to peak in 2025, with oil demand expected to peak before 2027. In 2023, coal accounted for nearly 60% of China's electricity supply. In comparison, the U.S., the world's second-largest energy consumer, produced about 60% of its electricity from fossil fuels in 2022.

While the country has increased its coal consumption over the last 3–5 years due to pandemic-induced volatility and increasing energy demand from the country, it has also deployed record levels of clean energy, with its total installed capacity surpassing 1000 GW in 2023. Giga-scale projects deployed during the first half of 2023 were greater than those of the rest of the world combined. China's installed clean energy additions totaled 46 GW in 1Q24, a 35.8% YoY growth. China’s total installed solar capacity of 660 GW is supplemented by record additions of wind and hydropower, which together will drive the decline in coal demand. At the current rate of deployment, China is projected to meet its goal of constructing 1,200 GW of renewable energy 5 years earlier than the initial target of 2030.

🔋 Battery Tech and Lithium Down 5%

The Battery Tech and Lithium index is down 5% year over year, and it has not reversed the decline seen in the latter half of 2023. Investor sentiment towards lithium producers has weakened, driving stock price declines across the index. Less than expected demand for EVs and declining prices of critical minerals such as lithium hydroxide have negatively impacted the battery index. EV manufacturers negotiating lower battery prices with suppliers have further impacted industry profitability.

Key players such as LG Energy Solution ($56B MCap), Toyota Motor Corp. ($322B MCap), and Vale SA ($50B MCap) have experienced share price declines of 23%, 19%, and 9%, respectively, over the past 3 months. LG Energy Solution reported a 30% decline in sales in Q1 2024 and has projected a slowdown in global EV demand for 2024. Major customers, like General Motors, struggled to meet EV production targets in 2023, with both GM and Ford Motor Co. planning a shift from nickel-based batteries to iron-based batteries. This shift could significantly impact LG Energy Solution's sales outlook. Investments in lithium technology are continuing despite short-term challenges, driven by advancements in extraction methods and sustained confidence in the future expansion of electric vehicle battery demand.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape across all world regions. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🦾 Vecna Robotics, a Massachusetts-based robotics and technology company, raised a $100M Series C to fund new workflow-specific innovations

🌍 Neustark, a Swiss carbon removal provider, raised $69M from decarbonization partners to scale operations and extend market reach.

🛠️ Prewave, an Austrian AI-based supply chain company, raised a $67.5M Series B from Hedosophia to enhance its AI-driven platform for supply chain risk and compliance management.

🌾 Oatside, a Singaporean oat milk startup, raised a $35.3M Series B to support its expansion into new markets and to enhance its production capabilities.

🚢 Hive, a German storage and shipping company, raised a $30.2M Series A from Earlybird to enhance brand operations throughout Europe.

M&A

⛏️ Paladin Energy, an Australian mining company, signed a definitive agreement to acquire Fission Uranium Corp for $833M a Canadian uranium mining company.

☀️ Nextracker, a California-based Intelligent solar solutions provider, acquired Ojjo, a California-based energy company.

⚡ THREE60 Energy, a UK-based energy service company, acquired Samphire, a UK-based engineering consulting firm.

🏠 Energystore, a UK-based manufacturer of insulation products, acquired Advanced Traditional Screeding, a UK-based floor construction company.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com