🩺 China Healthcare Up 3%. $150M+ VC funding.

Impact Capital Markets #86 looks at our China Healthcare stock index, major impact deals, M&A, and upcoming economic releases.

Olá 🏖️

📉 Today's Global Economic Update: In April 2024, the US unemployment rate increased to 3.9% from the previous month's 3.8%, defying market forecasts of stability. Despite a slight increase in employment levels, the number of unemployed individuals grew by 63,000, while the labor force participation rate held steady at 62.7%.

🧬 Deal of the Day: Latus Bio, a biotechnology company, raised a $54M Series A to speed up the advancement of its candidates for CLN2 disease.

What's New?

🩺 China Healthcare. China healthcare remains flat

💰 Funding. Biotech, EV charging & tech

💼 M&A. Vinted acquired Trendsales

📅 Economics. UK GDP data, US inflation, balance of trade + more

🩺 China Healthcare Remains Flat

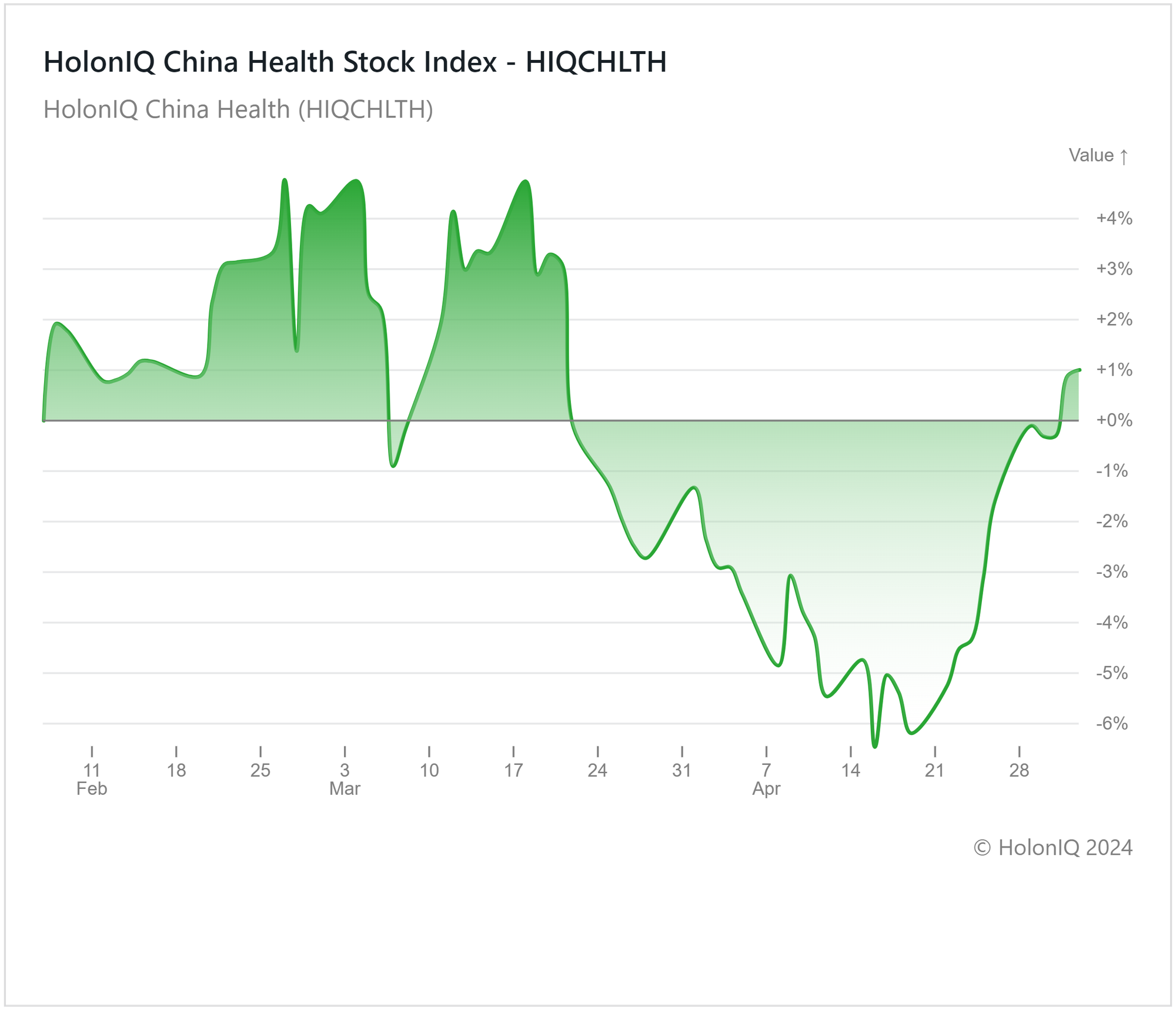

HolonIQ’s China Healthcare index experienced fluctuations over the past three months, marked by multiple peaks. Despite this volatility, the sector has rebounded to 1% growth from the decline observed in mid-April. The volatility can be attributed to various factors, including strains from the global health crisis, economic disruptions, and policy challenges. Economic uncertainties, along with supply chain disruptions and trade tensions, have impacted the availability and affordability of essential medical supplies, medications, and equipment.

Despite these challenges, the government is actively taking measures to stimulate growth in the healthcare industry. These efforts include investments in infrastructure, extending healthcare coverage, and promoting innovation. Such initiatives underscore a strong commitment to overcoming obstacles and achieving sustainable advancement in healthcare. Key stocks in the healthcare index, including BeiGene ($17.6B MCap), WuXi AppTec ($17.2B MCap), and Aier Eye Hospital Group ($16.6B MCap), have demonstrated diverse trends during this period. While BeiGene showed growth of 6%, WuXi AppTec experienced a decline of 7%, coinciding with the company's assertion of no ties to China's military and its commitment to operations free of national security risks. This decline had a notable impact on the broader biotech and pharmaceutical sectors, resulting in a collective loss of approximately $17 billion in market capitalization.

💰 Funding

🧬 Latus Bio, a Pennsylvania-based biotechnology company, raised a $54M Series A from 8VC and DCVC Bio to speed up the advancement of its candidates for CLN2 disease.

🚗 EnviroSpark, an Atlanta, Georgia-based EV charging company, raised $50M from Basalt Infrastructure Partners to broaden its proprietary network throughout the United States.

🖥️ Lamini, a California-based tech firm, raised a $25M Series A from Amplify Partners & First Round Capital to speed up technical enhancements and grow the team.

💼 M&A

👗 Vinted, a UK-based C2C marketplace, acquired Trendsales, a Danish fashion and lifestyle marketplace.

📅 Economic Calendar

UK GDP Data, US Inflation, Balance of Trade + More

Tuesday, May 7th 2024

🇦🇺 Australia RBA Interest Decision

🇩🇪 Germany Balance of Trade Data, March

🇨🇦 Canada Ivey PMI s.a, April

Wednesday, May 8th 2024

🇨🇳 China Balance of Trade Data, April

Thursday, May 9th 2024

Friday, May 10th 2024

🇬🇧 UK GDP Data, Q1

🇨🇦 Canada Employment Data, April

🇺🇸 US Michigan Consumer Sentiment (Preliminary), May

🇨🇳 China Inflation Data, April

Tuesday, May 14th 2024

🇬🇧 UK Employment Data, March

🇩🇪 Germany ZEW Economic Sentiment Index, May

🇺🇸 US PPI, April

Wednesday, May 15th 2024

🇺🇸 US Core Inflation Data, April

🇺🇸 US Inflation Data, April

🇺🇸 US Retail Sales Data, April

Thursday, May 16th 2024

🇺🇸 US Building Permits (Preliminary), April

🇯🇵 Japan GDP Data (Preliminary), Q1

🇨🇳 China Industrial Production Data, April

🇨🇳 China Retail Sales Data, April

Friday, May 17th 2024

🇯🇵 Japan Inflation Data, April

🇯🇵 Japan Balance of Trade Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com