🔋Battery Tech & Lithium Up 4%. $130M+ VC Funding.

Impact Capital Markets #71 looks at our Battery Tech & Lithium stock index, major impact deals, M&A, and upcoming economic releases.

Kedu 🌴

📉 Today's Global Economic Update: China's Balance of Trade Data released last Friday reveals that in March 2024, the country's trade surplus decreased to USD 58.6B, below market expectations, driven by a 7.5% drop in exports and a 1.9% fall in imports.

🌱 Deal of the Day: Spiber, a biotech company, raised $65M to accelerate mass production of its brewed protein product.

What's New?

🔋Battery Tech & Lithium. Battery tech & lithium up 4%

💰 Funding. Biotech & ocean carbon capture

💼 M&A. Ophthalmic tools & green hydrogen

📅 Economics. China GDP data, inflation, retail Sales, balance of trade + more

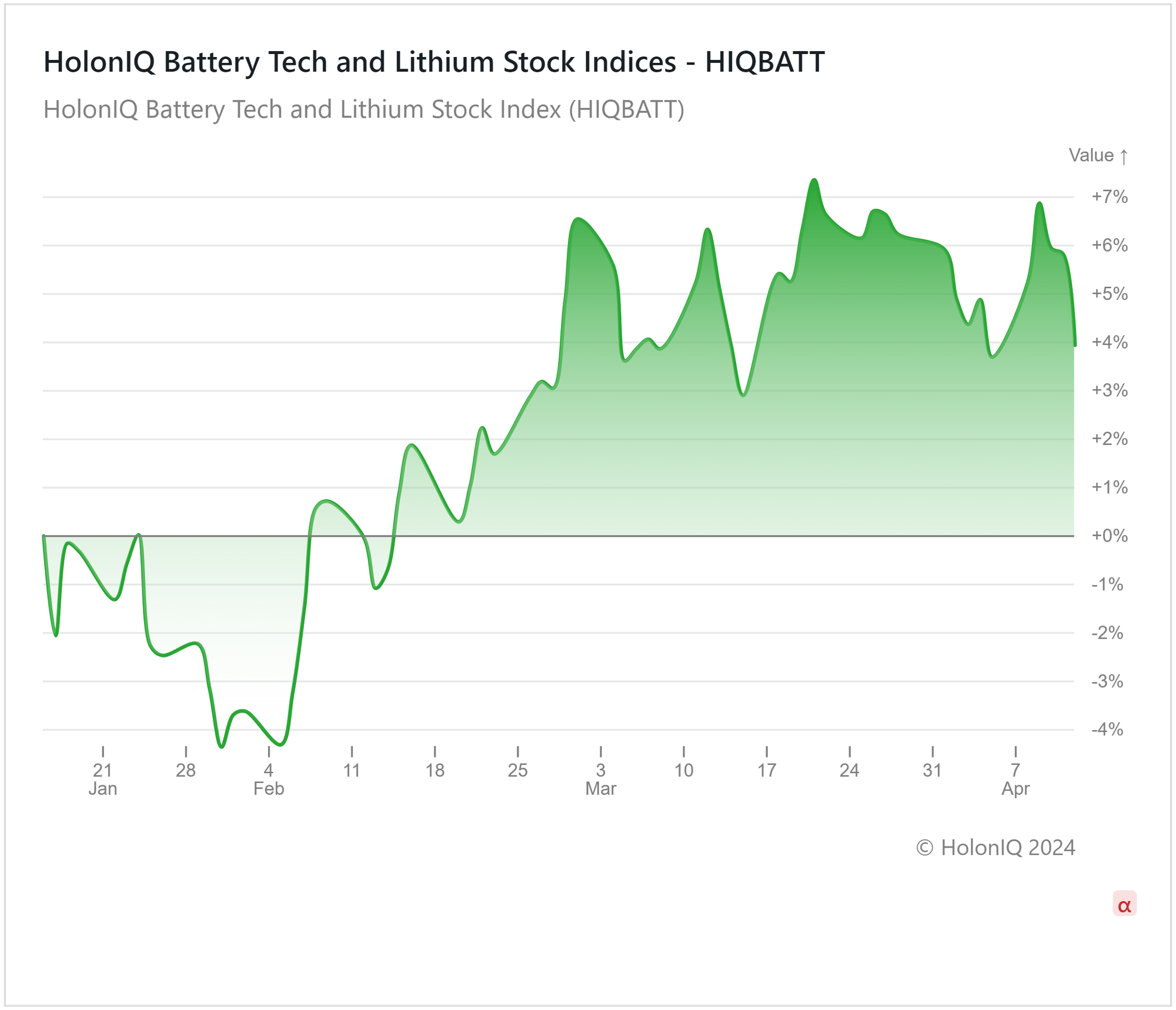

🔋Battery Tech and Lithium Up 4%

HolonIQ’s Battery tech & Lithium index has recorded a 4% growth in the past three months amidst market fluctuations in the global EV market. This growth has been primarily led by Toyota Motor Corp. (MCap: $331B), CATL (MCap: $117B) whose stocks have witnessed a 25%, 18% growth over the past 3 months respectively.

The lithium-ion battery market is anticipated to experience rapid growth in the coming years, driven by the increasing demand for hybrid and electric vehicles, as well as advancements in battery technologies such as the emergence of solid-state batteries at a commercial scale. The attractiveness of solid-state batteries was made further evident when in February, Chinese battery giants CATL, BYD ($82B MCap), and NIO teamed up to establish the China All-Solid-State Battery Collaborative Innovation Platform (CASIP) to develop next-gen EV batteries that will compete globally. Increased lithium production and reduced electric vehicle sales have resulted in an oversupply in the market which has impacted profitability for these companies. However, the cost reduction in battery manufacturing stemming from technological advances coupled with an anticipated increase in demand is expected to result in an upward trajectory for the remainder of the year.

💰 Funding

🌱 Spiber, a Japan-based biotech company, raised $65M to accelerate mass production of its brewed protein product.

🌊 Captura, a California-based direct ocean carbon capture company, raised a $45.3M Series A to expand operations and its business reach.

💼 M&A

🌿 Alpiq, a Swiss energy company, acquired a controlling stake in P2X Solutions Ltd for $50.2M, a Finnish green hydrogen producer.

👁️ Warburg Pincus, a New York-based private equity firm, acquired a majority stake in Appasamy Associates, an Indian eye surgical & diagnostic equipment manufacturer.

📅 Economic Calendar

China GDP Data, Inflation, Retail Sales, Balance of Trade + More

Monday, April 15th 2024

🇺🇸 US Retail Sales Data, March

🇨🇳 China GDP Growth Data, Q1

🇨🇳 China Industrial Production Data, March

🇨🇳 China Retail Sales Data, March

Tuesday, April 16th 2024

🇬🇧 UK Employment Data, February

🇩🇪 Germany ZEW Economic Sentiment Index, April

🇨🇦 Canada Inflation Data, March

🇺🇸 US Building Permits (Preliminary), March

🇯🇵 Japan Balance of Trade Data, March

Wednesday, April 17th 2024

Thursday, April 18th 2024

🇯🇵 Japan Inflation Data, March

Friday, April 19th 2024

🇬🇧 UK Retail Sales Data, March

Tuesday, April 23rd 2024

🇩🇪 Germany HCOB Manufacturing PMI (Flash), April

🇦🇺 Australia Inflation Data, Q1

Wednesday, April 24th 2024

🇩🇪 Germany Ifo Business Climate Index, April

🇺🇸 US Durable Goods Orders Data, March

Thursday, April 25th 2024

🇩🇪 Germany GfK Consumer Confidence Index, May

🇺🇸 US GDP Growth Data, Q1

🇯🇵 Japan BoJ Interest Rate Decision

Friday, April 26th 2024

🇺🇸 US Core PCE Price Index, March

🇺🇸 US Personal Income & Spending, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com