🔋 China Controls ~65% of the Global Battery Market + MENA Climate Tech 50

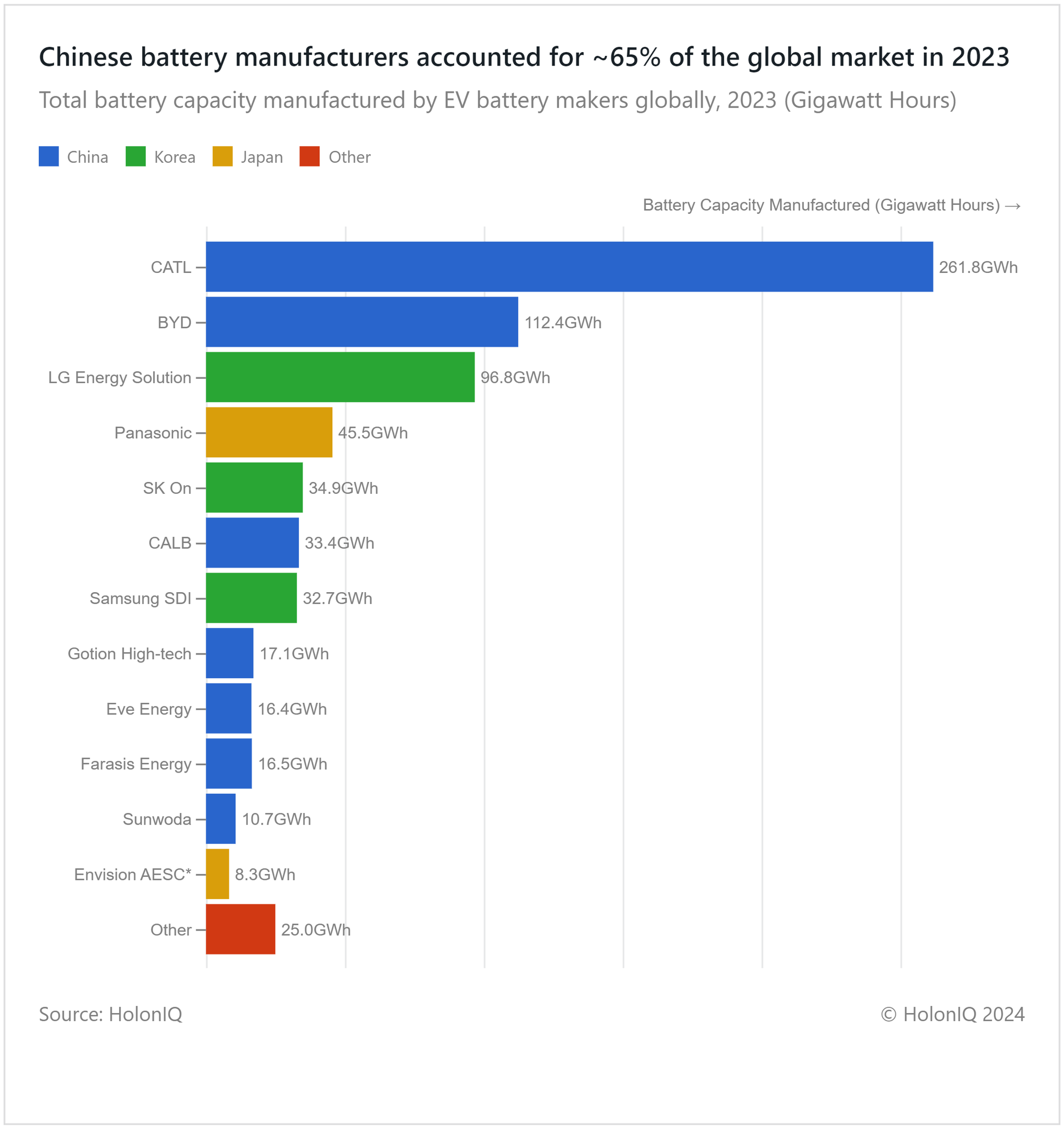

Chinese battery manufacturers increased their share to 58% in the global market last year, driven by rising demand. CATL and BYD now control half of this market, solidifying China's grip in a sector crucial for the next 2-3 decades as the world races towards net zero goals.

Happy Monday 👋

China continues to maintain its hold on the global battery market at ~65% market share, with major players CATL and BYD accounting for more than 50%. This week, we also spotlight the 2023 MENA Climate Tech 50, highlighting the region's most promising startups in the climate technology sector and how they are faring in 2024.

This Week's Topics

🔋 Battery Industry. China controls ~65% of the global market

🔋 Battery Tech and Lithium Stock Index. Index up 4%

🏆 MENA Climate Tech 50. 112.5M fundraising to date

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding for green hydrogen, food tech + more

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🔋 China Controls ~65% of the Global Battery Market

Chinese battery manufacturers continue to maintain their dominant market share of nearly two-thirds of all batteries produced. CATL and BYD together account for more than 50% of the global market. BYD is the largest EV manufacturer and produces its own batteries, and CATL is the largest supplier to EV OEMs. These two companies have solidified China's lead in the sector, which will become vital over the next 2-3 decades as the world accelerates its transition to meet net zero goals. This is in addition to China's lead in other clean technology sectors such as solar, wind, electric vehicles, and electrolyzers.

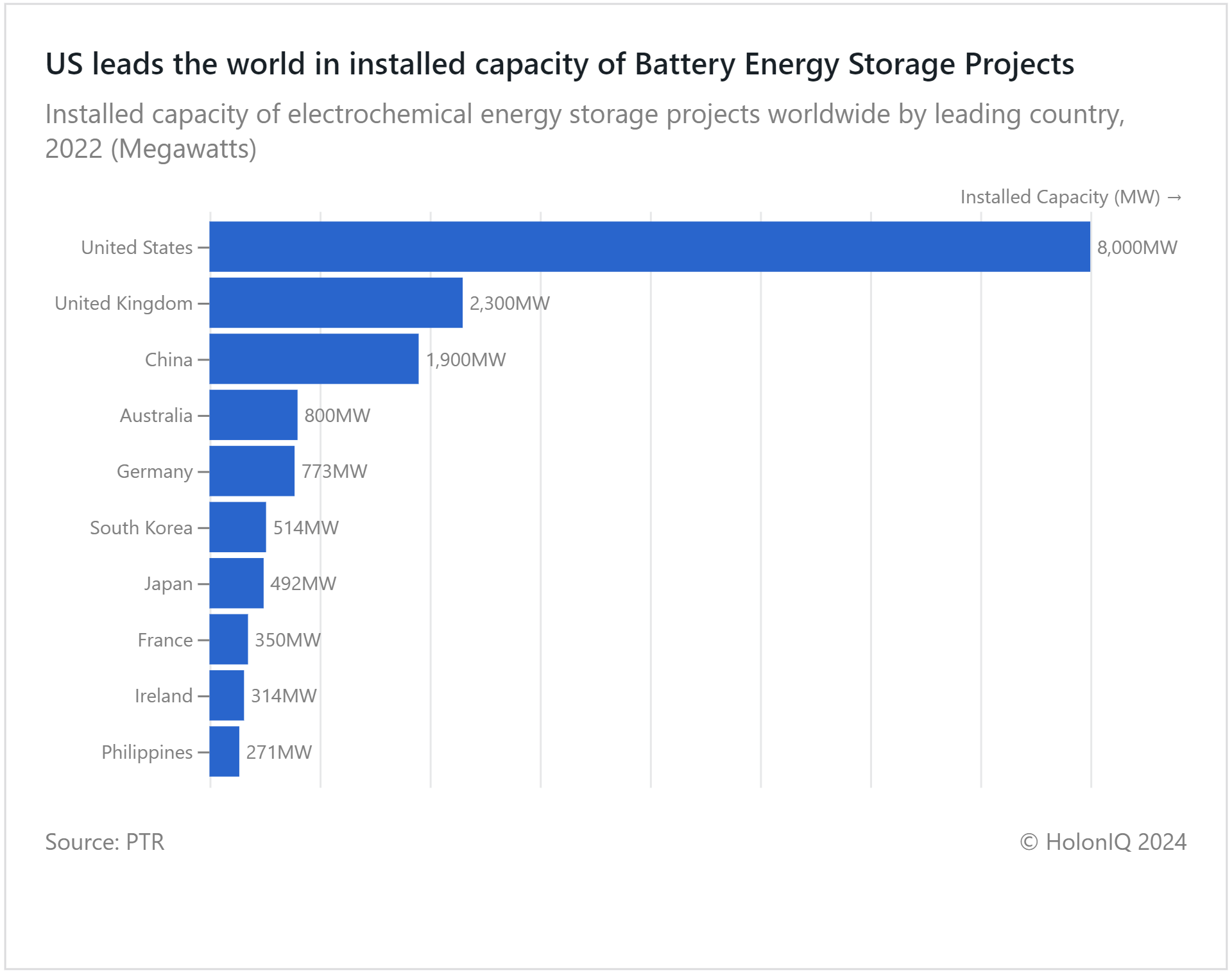

While China, Japan, and South Korea account for 90% of the global battery production market, Europe and North America lead in energy storage installations. They also rank second and third in EV sales, behind China, while the rest of Asia lags behind. This can be attributed to the disparity in living standards, prices, and other socio-economic factors coupled with a lack of effective government policies. Tax rebates and subsidies have proven to be instrumental in driving adoption and sales in the West.

While the EV sector slowed down in the second half of 2023, the demand from the energy storage sector increased exponentially as the deployment of clean energy projects required the installation of battery energy storage systems (BESS). The global market for BESS doubled in 2023, reaching over 90 GWh and increasing the volume of battery storage in use to more than 190 GWh. 65% of this capacity growth came from utility-scale systems, while behind-the-meter battery storage accounted for 35%. The increase was driven by China, the EU, and the US, which collectively accounted for nearly 90% of the added capacity.

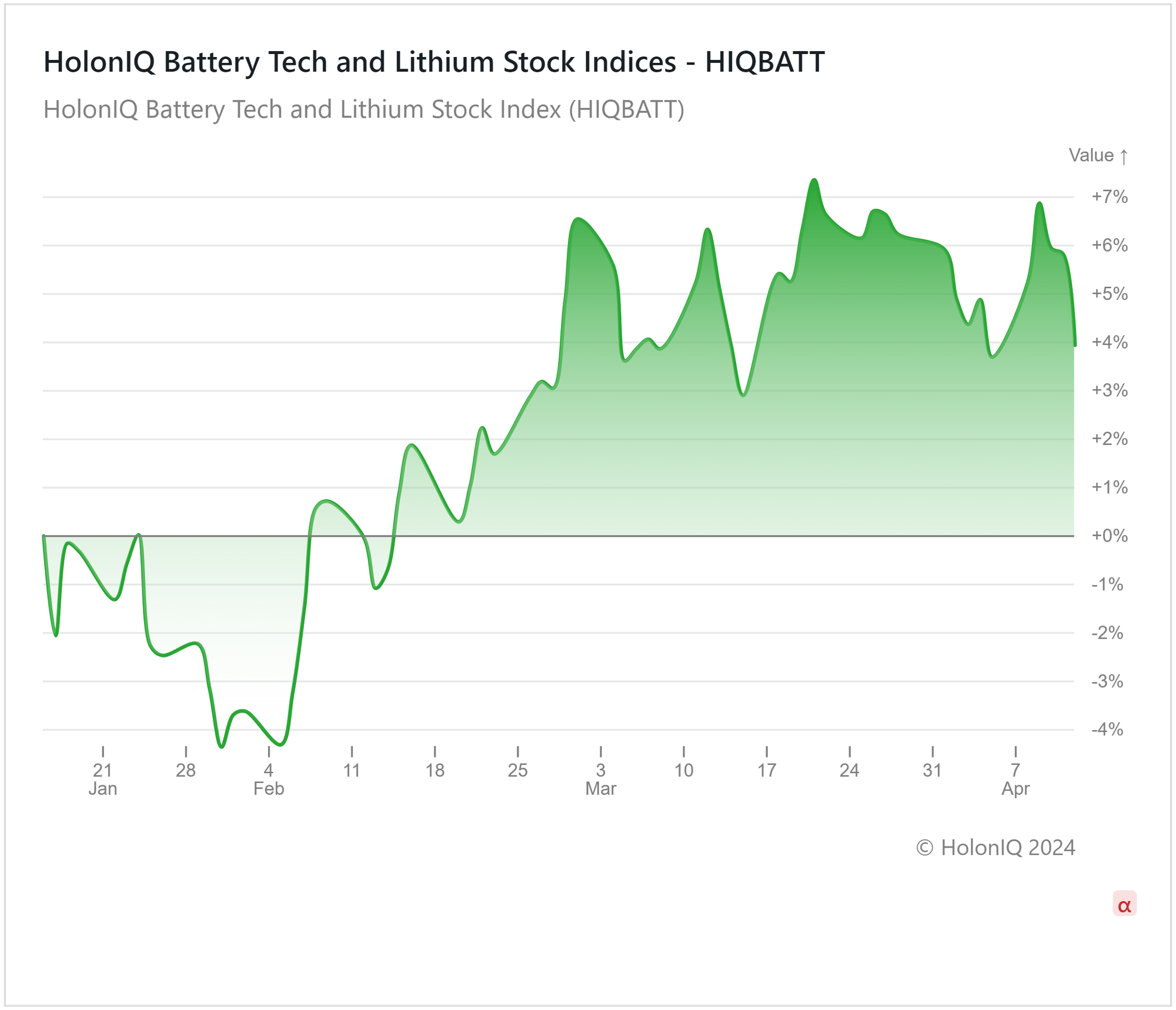

🔋Battery Tech and Lithium Up 4%

HolonIQ tracks thousands of listed climate tech companies worldwide, as well as acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over ten different sectors in Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ’s Battery tech & Lithium index recorded a 4% growth in the past three months amidst market fluctuations in the global EV market. This growth has been primarily led by Toyota Motor Corp. (MCap: $331B) and CATL (MCap: $117B), whose stocks have witnessed a 25% and 18% growth over the past three months, respectively.

The lithium-ion battery market is anticipated to experience rapid growth in the coming years, driven by the increasing demand for hybrid and electric vehicles, as well as advancements in battery technologies such as the emergence of solid-state batteries at a commercial scale. The attractiveness of solid-state batteries was made further evident when, in February, Chinese battery leaders CATL, BYD ($82B MCap), and NIO teamed up to establish the China All-Solid-State Battery Collaborative Innovation Platform (CASIP) to develop next-gen EV batteries that will compete globally. Increased lithium production and reduced electric vehicle sales have resulted in an oversupply in the market, which has impacted profitability for these companies. However, the cost reduction in battery manufacturing stemming from technological advances coupled with an anticipated increase in demand is expected to result in an upward trajectory for the remainder of the year.

🏆 MENA Climate Tech 50

The MENA Climate Tech 50 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

The MENA region secured over $631M in VC funding for climate tech startups, primarily in Israel, UAE, and Saudi Arabia. Food Systems and Circular Economy led the list, with 60% of startups from Israel and UAE. These companies have raised 112.5M so far in 2024, up from the 90.9M they raised in the same period last year. The Middle East region is rapidly becoming a key player in the climate tech space, with the oil-rich nations pivoting to become leaders in the hydrogen, carbon markets, and renewables sectors. Israeli startup Exodigo, which specializes in creating 3D maps of underground utilities without the need for digging, successfully secured a $105 million Series A funding round, making it the largest deal to date for this year.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🌍 Arbol, a New York-based climate risk solution provider, raised a $60M Series B from Giant Ventures and Opera Tech Ventures to support its expansion into agriculture and renewable energy.

💧 Stargate Hydrogen, an Estonia-based green hydrogen company, raised a $45M Seed from UG Investments and IPCEI to scale its operations.

💻 Thintronics, a California-based electronic materials startup, raised a $23M Series A from Maverick Capital and Translink Capital to help bring a new type of insulating material to the market.

🌱 Solar Foods, a Finnish food-tech startup raised a $8.6M Series B from Springvest to expand operations.

🤖 Niqo Robotics, an Indian agritech robotics firm, raised a $9M Series B from Brida Innovation Ventures. The funding will help the company further its mission of reshaping crop care.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com