🔋 Battery Tech and Lithium Down 5%. $700M+ VC Funding Day.

Impact Capital Markets #123 looks at our Battery Tech and Lithium Stock Index, major impact deals, M&A, and upcoming economic releases.

Bula 🌴

📉 Today's Global Economic Update: Germany's consumer confidence index fell to -21.8 in July from -21.0 in June, reversing four months of marginal improvements. Despite strong wage growth, economic uncertainties persist, dampening consumer spending in Europe's largest economy.

🤖 Deal of the Day: EvolutionaryScale, a New York-based biological AI therapeutics developer, raised a $142M Seed to advance its artificial intelligence capabilities focused on biology.

What's New?

🔋 Battery Tech and Lithium. Battery tech and lithium down 5%

💰 Funding. Bio AI, medical devices, biotechnology + more

💼 M&A. Flooring services, specialty pharma, and clinical research

📅 Economics. US GDP, Euro area inflation, balance of trade + more

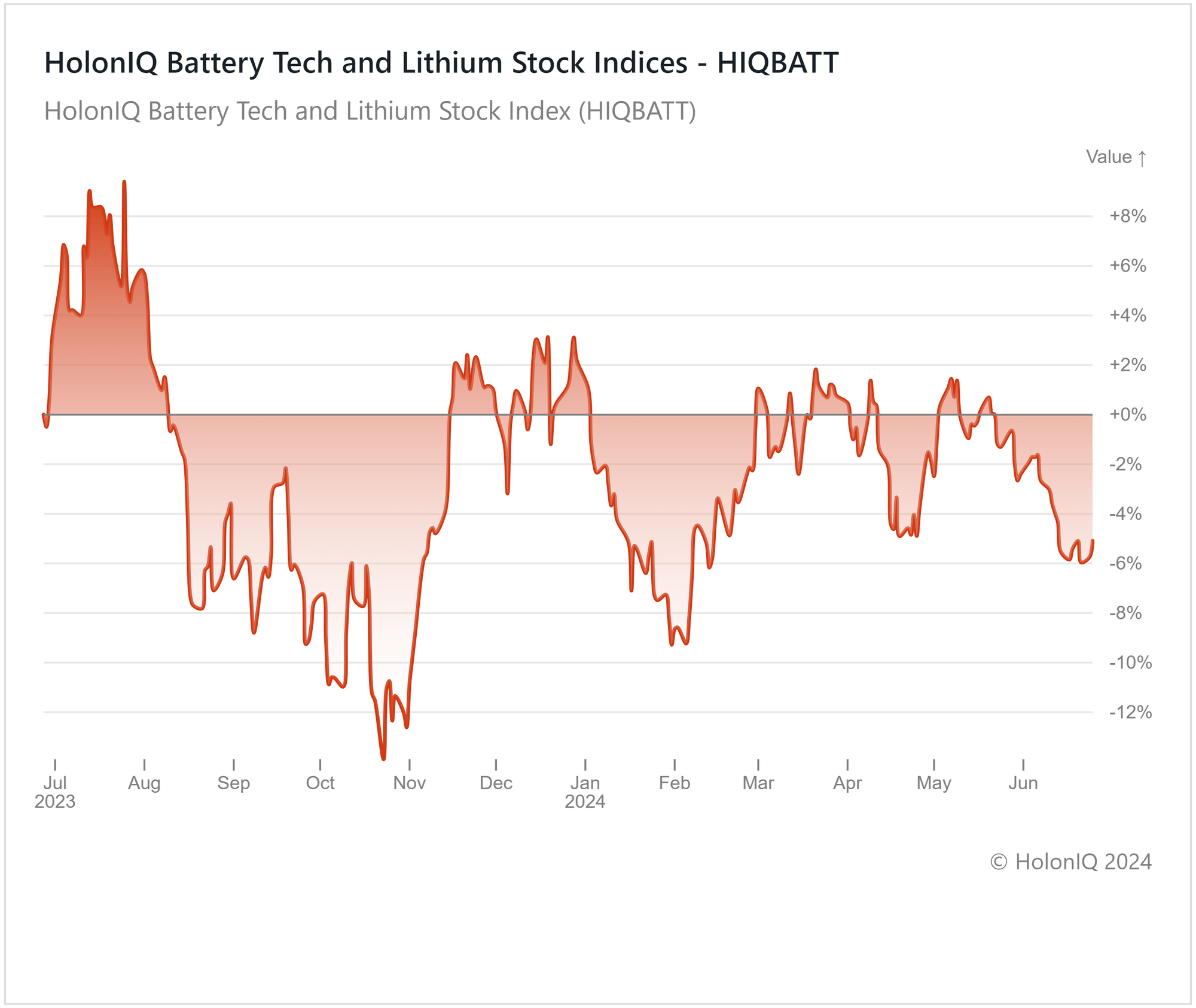

🔋 Battery Tech and Lithium Down 5%

Battery Tech and Lithium index is down 5% YOY, with the index not having yet reversed the decline seen in the latter half of 2023. Investor sentiment towards lithium producers has weakened, driving notable stock price declines. This downturn is compounded by sluggish sales of EV batteries and decreasing prices for critical materials like lithium hydroxide. EV manufacturers negotiating lower battery prices with suppliers have further impacted industry profitability.

Key players such as LG Energy Solution ($56B MCap), Toyota Motor Corp ($322B MCap), and Vale SA ($50B MCap) have experienced share price declines of 23%, 19%, and 9% respectively over the past 3 months. LG Energy Solution, which reported a 30% decline in sales in Q1 2024, has also projected a potential slowdown in global EV demand for 2024. Major customers of the company, like General Motors, struggled to meet EV production targets in 2023, with both GM and Ford Motor Co. planning a shift from nickel-based batteries to iron-based batteries. This shift could significantly impact LG Energy Solution's sales outlook. Despite short-term challenges, investments in lithium technology are continuing, driven by advancements in extraction methods and sustained confidence in the future expansion of electric vehicle battery demand.

💰 Funding

🤖 EvolutionaryScale, a New York-based biological AI therapeutics developer, raised a $142M Seed from Nat Friedman, Daniel Gross, and Lux Capital to advance its artificial intelligence capabilities focused on biology.

💻 Bright Machines, a California-based software company, raised a $126M Series C from BlackRock to launch new products, enhance software flexibility, and build partnerships with ecosystem partners.

🔬 Endogenex, a Minnesota-based medical device company, raised a $88M Series C to complete the pivotal ReCET (Re-Cellularization via Electroporation Therapy) Clinical Study.

🧬 Exsilio Therapeutics, a Massachusetts-based biotechnology company, raised $82M Series A from Novartis Venture Fund and Delos Capital to scale its operations.

💊 Function, a Texas-based healthcare platform, raised a $53M Series A from Andreessen Horowitz to expand its technology and increase access to whole-body testing.

💉 UroMems, a French med-tech company, raised a $47M Series C from Crédit Mutuel Innovation to finance pivotal clinical trials for the UroActive™ System, the first smart implant for stress urinary incontinence.

💰 Adonis, a New York-based health finance tech company, raised a $31M Series B from Point72 Private Investments to speed up product innovation.

🧬 Augustine Therapeutics, a Belgian biopharmaceutical company, raised a $18.2M Series A from Asabys Partners to advance its lead candidate into a clinical trial.

💼 M&A

🏠 Energystore, a UK-based manufacturer of insulation products, acquired Advanced Traditional Screeding, a UK-based floor construction company.

💊 Frazier Healthcare Partners, a Washington-based healthcare investment firm, acquired BioMatrix Specialty Pharmacy, a Florida-based specialty pharmacy platform company.

🔬 ToxStrategies, a North Carolina-based scientific consulting firm, acquired Clintrex Research Corporation, a Florida-based clinical research company.

📅 Economic Calendar

US GDP, Euro Area Inflation, Balance of Trade + More

Wednesday, June 26th 2024

🇩🇪 Germany GfK Consumer Confidence, July

Thursday, June 27th 2024

🇺🇸 US Durable Goods Orders, May

🇺🇸 US GDP Growth Data, Q1

Friday, June 28th 2024

🇫🇷 France Inflation Data (Preliminary), June

🇮🇹 Italy Inflation Data (Preliminary), June

🇺🇸 US Core PCE Price Index, May

🇺🇸 US Personal Income & Spending Data, May

Monday, July 1st 2024

🇯🇵 Japan Consumer Confidence, June

🇩🇪 Germany Inflation Data (Preliminary), June

🇺🇸 US ISM Manufacturing PMI, June

Tuesday, July 2nd 2024

🇪🇦 Euro Area Inflation Data, June

🇺🇸 US JOLTs Job Openings, May

Wednesday, July 3rd 2024

🇨🇦 Canada Balance of Trade, May

🇺🇸 US ISM Services PMI, June

🇦🇺 Australia Balance of Trade, May

Friday, July 5th 2024

🇨🇦 Canada Employment Data, June

🇺🇸 US Employment Data, June

🇨🇦 Canada Ivey PMI s.a, June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com