🤖 AI Stock Index Up 46%. $165M+ VC Funding.

Impact Capital Markets #116 looks at our AI Stock Index, major impact deals, M&A, and upcoming economic releases.

📉 Today's Global Economic Update: China's retail sales, a key indicator of household spending, surpassed expectations in May, rising by 3.7% year-on-year and exceeding the anticipated 3% increase. However, industrial output fell short of expectations, and property sales disappointed, increasing calls for more government support for the economy.

💊 Deal of the Day: Enveda Biosciences, a Colorado-based biotechnology company using AI to develop new medicines, raised a $55M Series B to expand operations.

What's New?

🤖 Artificial Intelligence. AI Index up 46%

💰 Funding. Biotechnology, autonomous driving, and advanced medicine

💼 M&A. Kauhale Health acquisition of The Parker

📅 Economics. Australia interest rate decision, US retail sales, major inflation data + more

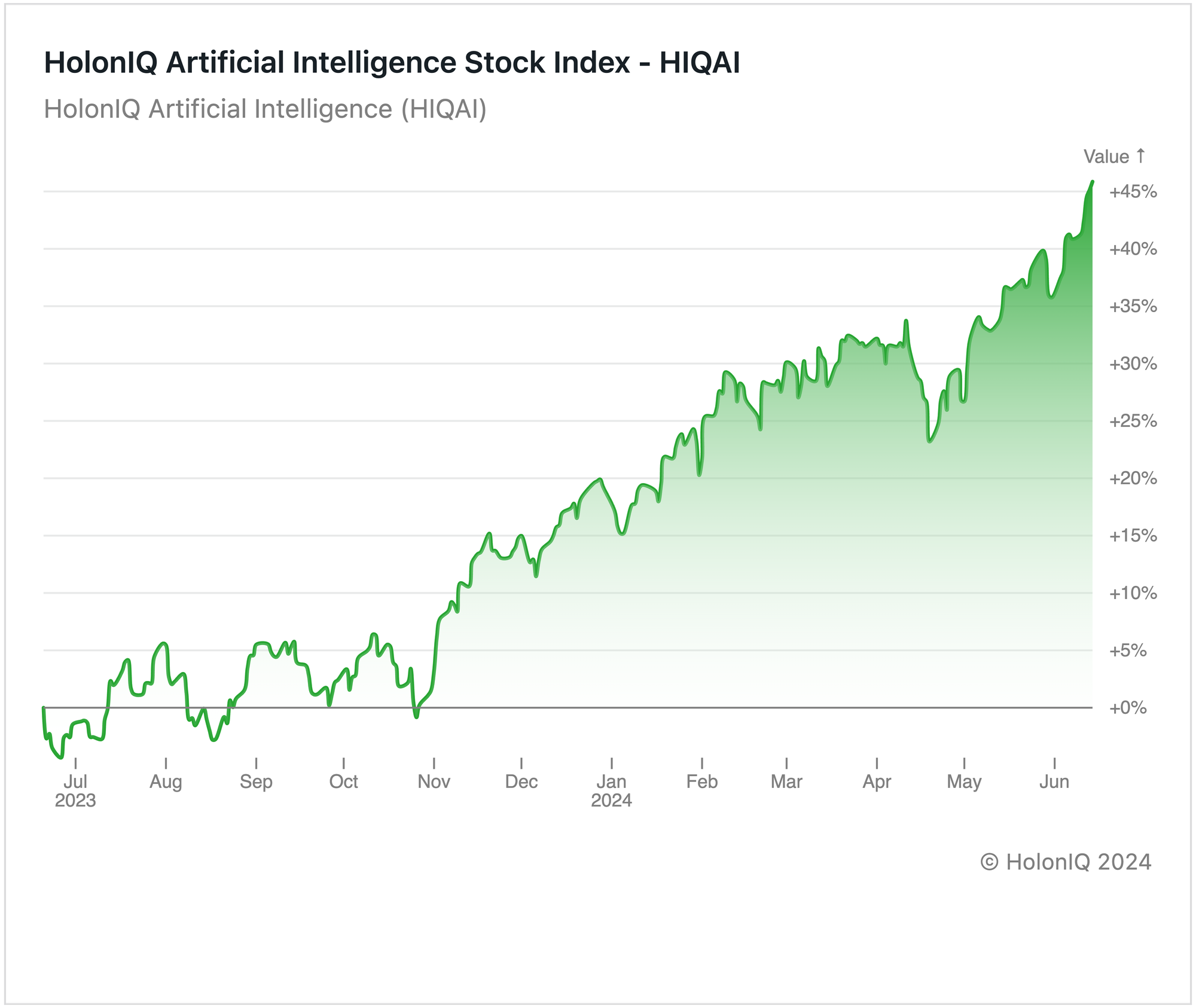

🤖 Artificial Intelligence Index Up 46%

HolonIQ’s Artificial Intelligence index is up more than 45% Year-on-Year and has risen 12% in the past three months, fueled by widespread AI adoption across industries and advancements in the chip sector. In March, the European Parliament passed the AI Act, hailed as the world's first broad legal framework for artificial intelligence, signaling a positive outlook for the sector.

Apple ($3.26T MCap) has reclaimed its position as the world’s largest company based on MCap, narrowly surpassing Microsoft. New AI features, such as Apple's digital assistant Siri's expanded capabilities, announced at their developer conference, have contributed to Apple's recent success. Microsoft ($3.29T MCap) and OpenAI are reportedly planning to build a $100B supercomputer with millions of specialized server chips, aiming to advance AI capabilities significantly. These developments in the AI sector have positively impacted major stocks, with Apple, Microsoft, and NVIDIA ($3.24T MCap) showing impressive 3-month returns of 22%, 6%, and 49%, respectively. This robust performance has helped drive the overall stock index upward. Investor confidence and increased government support for technology and innovation are also expected to sustain this growth trajectory.

💰 Funding

💊 Enveda Biosciences, a Colorado-based biotechnology company using AI to develop new medicines, raised a $55M Series B to expand operations.

🚗 TIER IV, a Japanese developer of open-source software for autonomous driving systems, raised a $54M Series B to deploy their technology.

🔬 Advanced Medicine Partners, a North Carolina-based developer of advanced medicines, raised $32M from Deerfield Management to expand operations.

💼 M&A

🏥 Kauhale Health, an Ohio-based healthcare company, acquired The Parker, a Greenville-based assisted living and memory care facility.

📅 Economic Calendar

Australia Interest Rate Decision, US Retail Sales, Major Inflation Data + More

Tuesday, June 18th 2024

🇦🇺 Australia RBA Interest Rate Decision

🇩🇪 Germany ZEW Economic Sentiment Index, June

🇺🇸 US Retail Sales Data, May

🇯🇵 Japan Balance of Trade, May

Wednesday, June 19th 2024

Thursday, June 20th 2024

🇬🇧 UK BoE Interest Rate Decision

🇺🇸 US Building Permits (Preliminary), May

🇯🇵 Japan Inflation Data, May

Friday, June 21st 2024

🇬🇧 UK Retail Sales Data, May

🇩🇪 Germany HCOB Manufacturing PMI (Flash), June

Monday, June 24th 2024

🇩🇪 Germany Ifo Business Climate, June

Tuesday, June 25th 2024

🇦🇺 Australia Westpac Consumer Confidence Change, June

🇨🇦 Canada Inflation Rate, May

Wednesday, June 26th 2024

🇩🇪 Germany GfK Consumer Confidence, July

Thursday, June 27th 2024

🇺🇸 US Durable Goods Orders, May

🇺🇸 US GDP Growth Rate, Q1

Friday, June 21st 2024

🇫🇷 France Inflation Rate (Preliminary), June

🇮🇹 Italy Inflation Rate (Preliminary), June

🇺🇸 US Core PCE Price Index, May

🇺🇸 US Personal Income & Spending, May

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com