🤖 AI Index Gains 11%. $265M+ VC Funding.

Impact Capital Markets #67 looks at our Artificial Intelligence stock index, major impact deals, M&A, and upcoming economic releases.

Hallo 🥨

📉 Today's Global Economic Update: Germany's trade surplus decreased to €21.4B ($23B) in February 2024, marking its lowest level since October. Exports fell by 2%, led by declines in shipments to the EU, while imports unexpectedly increased by 3.2%.

🧘 Deal of the Day: Grow Therapy, a startup providing mental health care, raised a $88M Series C to support the launch of its new system and increase access to its services.

What's New?

🤖 Artificial Intelligence. Artificial intelligence index gains 11%

💰 Funding. Mental health, biotech, agri tech + more

💼 M&A. Pharmaceuticals & health supplements

📅 Economics. UK GDP Data, inflation, balance of trade + more

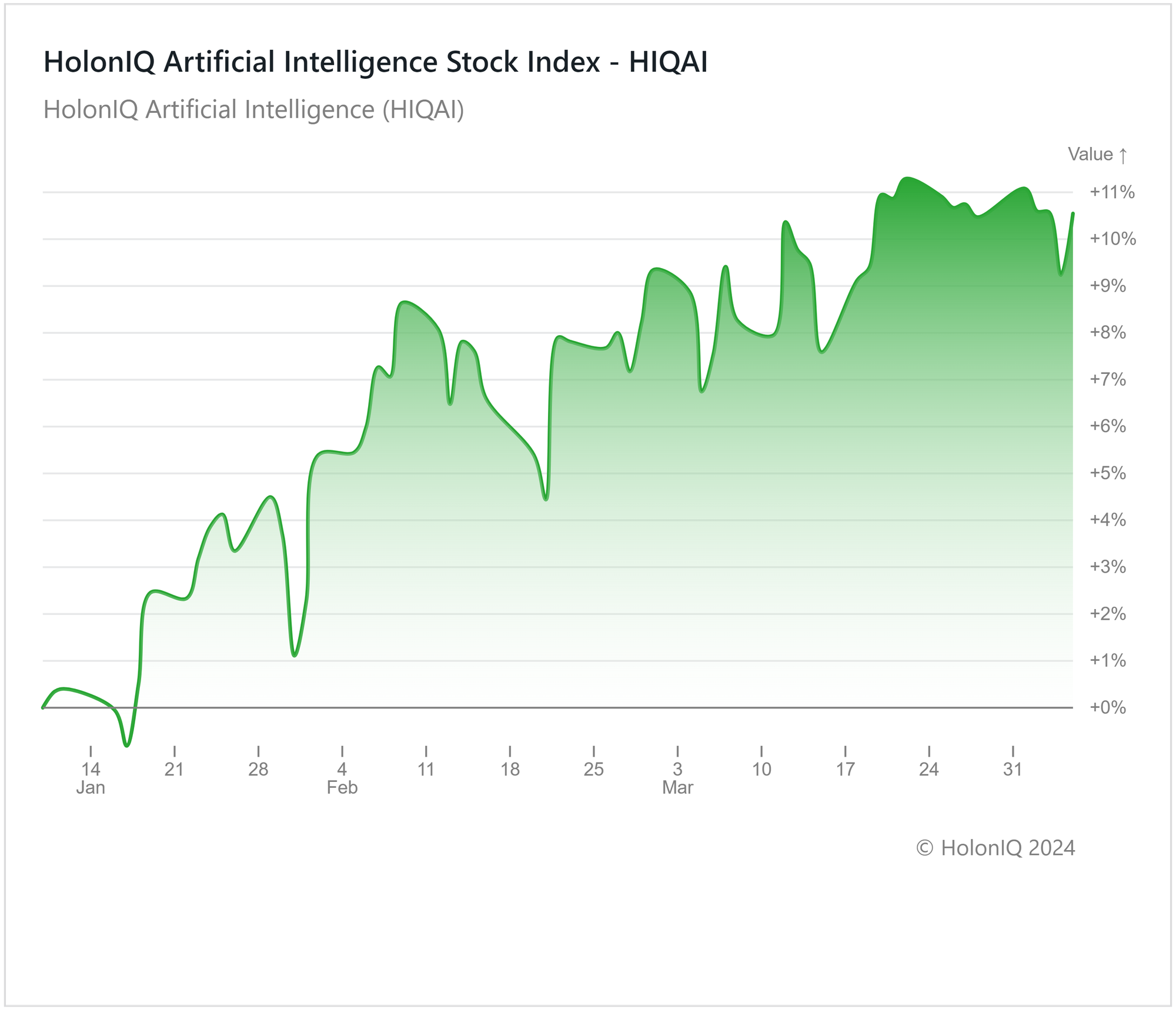

🤖 Artificial Intelligence Index Gains 11%

HolonIQ's Artificial Intelligence index experienced an 11% increase last quarter, maintaining the upward momentum that has helped yearly returns reach 50%+. Major stocks in the index, including Microsoft Corp ($3T MCap), NVIDIA Corp ($2T MCap), and Amazon ($2T MCap), experienced increases of 13%, 64%, and 21%, respectively. The HIQAI outperformed the S&P500, which returned ~29% over the past year.

With AI adoption on the rise and governments pushing AI funding, market sentiment for the industry has been immensely positive. Nvidia has seen exceptional growth, pushing the index up, with the reveal of its most powerful chip in March bolstering investor confidence. Microsoft is expanding its AI capabilities, recently announcing its plans to open a new office in London dedicated to artificial intelligence. Apple ($3T MCap) was a notable exception to the positive trend, registering an 8% decline in the quarter due to flat revenue growth and the view that it is lagging behind its competitors in AI capabilities. Despite individual setbacks, the AI industry continues to thrive. As investors acknowledge the potential for growth and innovation within the AI space, the sector remains primed for further growth.

💰 Funding

🧘 Grow Therapy, a New York-based technology startup providing mental health care, raised a $88M Series C from Sequoia Capital to support the launch of its new system and increase access to its services.

🧬 D3 Bio, a Chinese biotechnology company, raised a $62M Series A from Medicxi to advance its pipeline of cancer treatments.

🌱 Windfall Bio, a California-based agricultural technology company, raised a $28M Series A from Prelude Ventures to expand pilot deployments across methane-intensive industries.

🧪 Prem Labs, a Missouri-based applied research lab, raised a $14M Seed to expand operations and invest in R&D.

💊 Biodeal Pharmaceuticals, an Indian pharmaceutical manufacturing company, raised $13M through convertible notes to enhance its production capabilities.

🌡️ Kryptos Biotechnologies, a California-based thermal biotech company, raised a $10M Series A from Osang Healthcare to advance clinical studies of the firm's respiratory combination test.

🎓 Summer, a New York-based student loan solution provider, raised a $9M Series B from Rebalance Capital and SemperVirens to expand its leadership team.

💼 M&A

💻 Vista Credit Partners, a Texas-based investment company, has entered into a definitive agreement to acquire Model N, a California-based revenue management software provider for pharmaceuticals and medtech companies, for $1.25B.

💊 Smart for Life, a Florida-based nutritional food manufacturer, has entered into a definitive agreement to acquire Purely Optimal, an Ontario-based health supplement company.

📅 Economic Calendar

UK GDP Data, Inflation, Balance of Trade + More

Thursday, April 11th 2024

🇨🇳 China Inflation Data, March

🇪🇦 Euro Area ECB Interest Rate Decision

🇺🇸 US Producer Price Index, March

Friday, April 12th 2024

🇬🇧 UK GDP Data, February

🇺🇸 US United States Michigan Consumer Sentiment Index (Preliminary), April

Monday, April 15th 2024

🇺🇸 US Retail Sales Data, March

Tuesday, April 16th 2024

🇨🇳 China GDP Growth Data, Q1

🇨🇳 China Industrial Production Data, March

🇨🇳 China Retail Sales Data, March

🇬🇧 UK Employment Data, February

🇩🇪 Germany ZEW Economic Sentiment Index, April

🇨🇦 Canada Inflation Data, March

🇺🇸 US Building Permits Data (Preliminary), March

Wednesday, April 17th 2024

🇯🇵 Japan Balance of Trade Data, March

🇬🇧 UK Inflation Data, March

Friday, April 19th 2024

🇬🇧 UK Retail Sales Data, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com