🌾 AgTech Grows 3%. $1.3B+ VC Funding Day.

Impact Capital Markets #84 looks at our AgTech and Smart Farming stock index, major impact deals, M&A, and upcoming economic releases.

Xin chào 🍜

📉 Today's Global Economic Update: Euro Area GDP data, released last Wednesday, revealed a growth of 0.4% YOY, surpassing forecasts of 0.2%. This growth signals an improvement from the two previous quarters of 0.1% expansion.

🌐 Deal of the Day: CoreWeave, a New Jersey-based AI cloud provider, raised a $1.1B Series C from Coatue to expand operations.

What's New?

🌾 AgTech and Smart Farming. AgTech grows 3%, volatility continues

💰 Funding. Cloud services, math support, biotech + more

💼 M&A. Cancer treatment & healthcare marketing

📅 Economics. UK GDP, China inflation, employment data + more

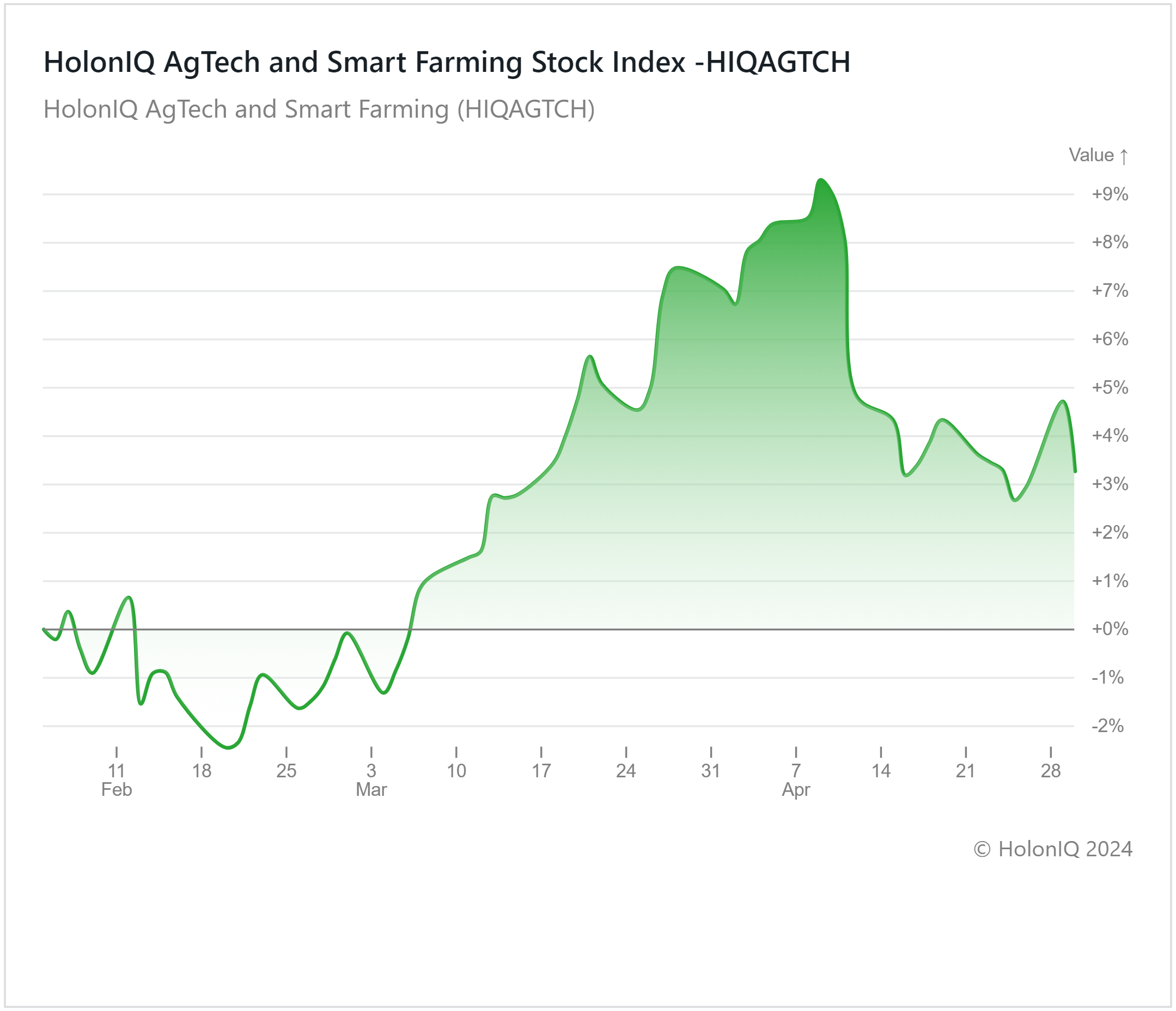

🌾 AgTech Grows 3%, Volatility Continues

HolonIQ’s Agtech & Smart farming index has risen by 3% over the past three months, rebounding from a downturn earlier in the period. On an annual basis, the Index is down 9%, with volatility in returns persisting. Agrichemical firms faced challenges in late 2023 due to droughts, floods, and insect infestations while developing countries also encounter specific agricultural issues, including limited resources, small landholdings, insufficient water, and credit. Additionally, agricultural and construction equipment manufacturers lowered full-year earnings guidance as demand from farmers reduced, resulting in a decline in stock prices.

In February, index performance began to improve following Q4 2023 earnings releases. Corteva's ($38B MCap) shares increased by over 18% backed by rising seed prices. Record corn production in North America for the 2023/24 harvest is expected to fuel profit growth in companies in the region. Rising demand for grains and crop-based biofuels is also improving prospects for the sector. These positive developments have translated into corresponding increases in stock prices, with Corteva ($38B MCap), Nutrien ($26B MCap), and Deere & Co ($108B MCap) experiencing gains of 5%, 4%, and 1% over the past three months. Trends including the integration of AI in agriculture, coupled with government support, promise to increase output, suggesting a positive outlook for the industry's long-term growth.

💰 Funding

🌐 CoreWeave, a New Jersey-based AI cloud provider, raised a $1.1B Series C from Coatue to expand operations.

🧮 National Math Stars, a US-based math support organization raised a $16.5M Seed to provide gifted kids with resources to excel in math and science.

💊 Remepy, a New York-based biotech firm, raised a $10M Seed from NFX to develop hybrid drugs.

🤖 Niqo Robotics, an Indian agritech robotics firm, raised a $9M Series B from Brida Innovation Ventures. The funding will help the company further its mission of reshaping crop care.

🏥 Piction Health, a Masachusetts-based telehealth dermatology company, raised a $6M Seed to build out its virtual dermatology clinic.

💼 M&A

🩺 Radformation, a New York-based cancer treatment optimization company acquired Limbus AI, a Canadian cancer radiation therapy software provider.

💊 Vector Consumer, a UK-based healthcare marketing agency acquired Dose & Co., an Auckland-based wellness innovation company.

📅 Economic Calendar

UK GDP, China Inflation, Employment Data, Balance of Trade + More

Thursday, May 2nd 2024

🇨🇦 Canada Balance of Trade Data, March

Friday, May 3rd 2024

🇺🇸 US Employment Data, April

🇺🇸 US ISM Services PMI, April

Tuesday, May 7th 2024

🇦🇺 Australia RBA Interest Decision

🇩🇪 Germany Balance of Trade Data, March

🇨🇦 Canada Ivey PMI s.a, April

Wednesday, May 8th 2024

🇨🇳 China Balance of Trade Data, April

Thursday, May 9th 2024

Friday, May 10th 2024

🇬🇧 UK GDP Data, Q1

🇨🇦 Canada Employment Data, April

🇺🇸 US Michigan Consumer Sentiment (Preliminary), May

🇨🇳 China Inflation Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com