💰 $600M+ VC Funding. China Biotech Down 30%.

Impact Capital Markets #44 looks at our China biotech stock index, major impact deals, M&A, and upcoming economic releases.

Ni Hao 🏮

📉 Today's Global Economic Update: China's Balance of Trade data showed an increase in its trade surplus to $125B for Jan-Feb 2024. Exports grew by 7.1%, surpassing predictions, while imports rose by 3.5%. The data underscores China's dominance in global trade, even amidst economic uncertainties.

🩺 Deal of the Day: Sionna Therapeutics, a clinical-stage life sciences company, raised a $182M Series C from Enavate Sciences to advance clinical developments.

What's New?

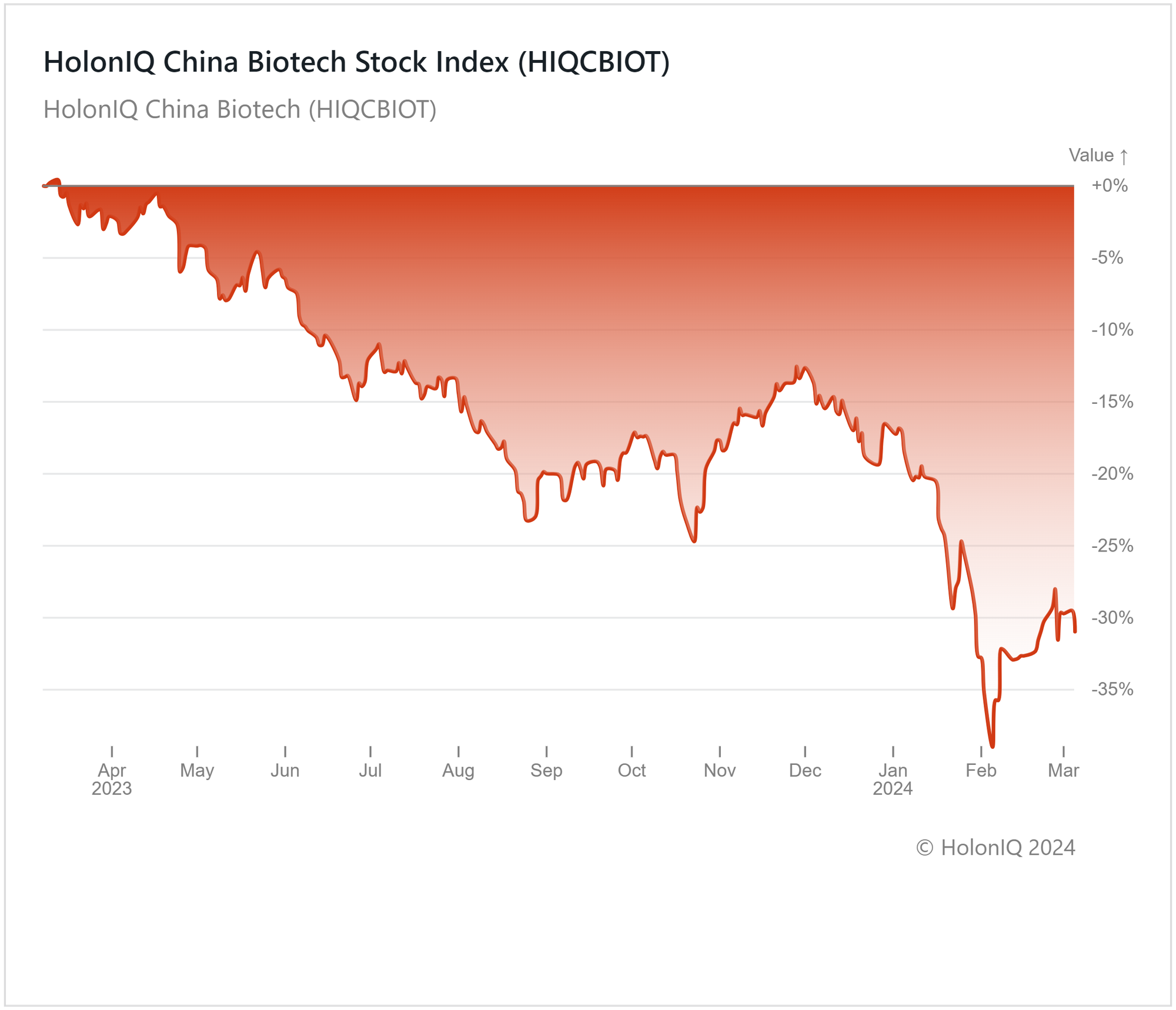

- 🧬 China Biotech. China's biotech index declines 30%

- 💰 Funding. Life sciences, cyber security, green gas, mental health & more

- 💼 M&A. BiomX's & Adaptive Phage Therapeutics merger agreement

- 📅 Economics. ECB interest rate decision, UK GDP, US inflation + more

For unlimited access to more deals and economic updates, request a demo

🧬 China's Biotech Index Declines 30%

HolonIQ's China Biotech Index has declined 30% over the past year after reaching lows of 40% in February. Major stocks in the index have fallen over the last 12 months, including WuXi AppTec Co, which declined 37% ($23B MCap), BeiGene by 16% ($18B MCap), and Chongqing Zhifei Biological Products, which fell 13% ($17B MCap).

Concerns surrounding US laws limiting Chinese firms' access to government contracts have increased selling pressure on stocks, particularly those of companies such as WuXi AppTec. China's healthcare sector is facing an anti-corruption crackdown, covering the entire chain of production across the pharmaceutical industry as well as medical institutions and funds. Such developments have the potential to bring about positive shifts in patient care, fostering long-term affordability. However, they have also introduced a source of uncertainty for companies within the industry.

💰 Funding

🩺 Sionna Therapeutics, a Massachusetts-based clinical-stage life sciences company, raised a $182M Series C from Enavate Sciences to advance clinical development for cystic fibrosis treatments.

🔒 Claroty, a New York-based cyber security company, raised $100M in private equity, to expand operations related to cyber-physical systems (CPS) protection.

💊 Nocion Therapeutics, a Watertown, Massachusetts-based biopharmaceutical company, raised a $62M Series B from Arkin Bio Capital and Monograph Capital. The funds will be used to advance a study on chronic coughs.

🌱 Matrix Gas & Renewables, an Indian green gas company, raised $42M from Sarda Group & NAV Capital Emerging Star Fund to accelerate its expansion.

🧑💼 Remofirst, a California-based HR solution company, raised a $25M Series A from Octopus Ventures to develop new products and services.

🤗 Tava Health, a Utah-based mental healthcare company, raised a $20M Series B from Catalyst Investors for product development and expansion of its network.

🏥 Nalu Medical, a California-based medical technology company, raised a $20M Series E from B Capital to expand operations.

🧬 C2N Diagnostics, a Missouri-based protein diagnostic and therapeutic discovery company, raised $15M from Eisai US. The funds will be used to provide access to high-performance blood biomarker tests used for the early diagnosis of Alzheimer’s disease.

🤖 Limbic, a UK-based company providing AI solutions for mental healthcare, raised a $14M Series A from Khosla Ventures to expand into the US.

🌍 Greenlyte Carbon Technologies, a German clean technology startup, raised a $11.4M Seed to expand its team and support tech developments.

🫀 Chamber Cardio, a Columbia-based cardio tech solutions provider, raised $8M from General Catalyst to expand technological developments.

🔄 Glacier, a California-based recycling robotics company, raised $7.7M from NEA and Amazon’s Climate Pledge Fund to expand its team and develop its robotics technology.

💼 M&A

🧬 BiomX, an Israeli clinical-stage company, entered into a definitive merger agreement with Adaptive Phage Therapeutics, a Maryland-based clinical-stage biotechnology company.

📅 Economic Calendar

ECB Interest Rate Decision, UK GDP, US Inflation + More

Thursday, March 7th 2024

🇪🇦 ECB Interest Rate Decision

🇨🇦 Canada Balance of Trade, January

Friday, March 8th 2024

🇨🇦 Canada Unemployment Data, February

🇺🇸 US Non-Farm Payrolls, February

🇺🇸 US Unemployment Data, February

Tuesday, March 12th 2024

🇦🇺 Australia NAB Business Confidence, February

🇬🇧 UK Unemployment Data, January

🇺🇸 US Core Inflation Data, February

🇺🇸 US Inflation Data, February

Wednesday, March 13th 2024

Thursday, March 14th 2024

🇺🇸 US PPI Data, February

🇺🇸 US Retail Sales Data, February

Friday, March 15th 2024

🇺🇸 US Michigan Consumer Sentiment (Preliminary), March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com