💰 $530M Impact VC Funding. Minerals Market Dips 29%.

Impact Capital Markets #28 looks at our Critical Minerals Stock Index, major impact deals and acquisitions, and the upcoming economic releases.

Namaste 🕌

📉 Today's Global Economic Update: Germany's ZEW Economic Sentiment rose to +19.9 in February 2024, beating expectations, driven by hopes of central bank rate cuts. However, the assessment of Germany's economic situation fell to -81.7, its lowest since June 2020.

💊 Deal of the Day: BioAge Labs raised $170M in Series D to advance its metabolic disease treatment.

What's New?

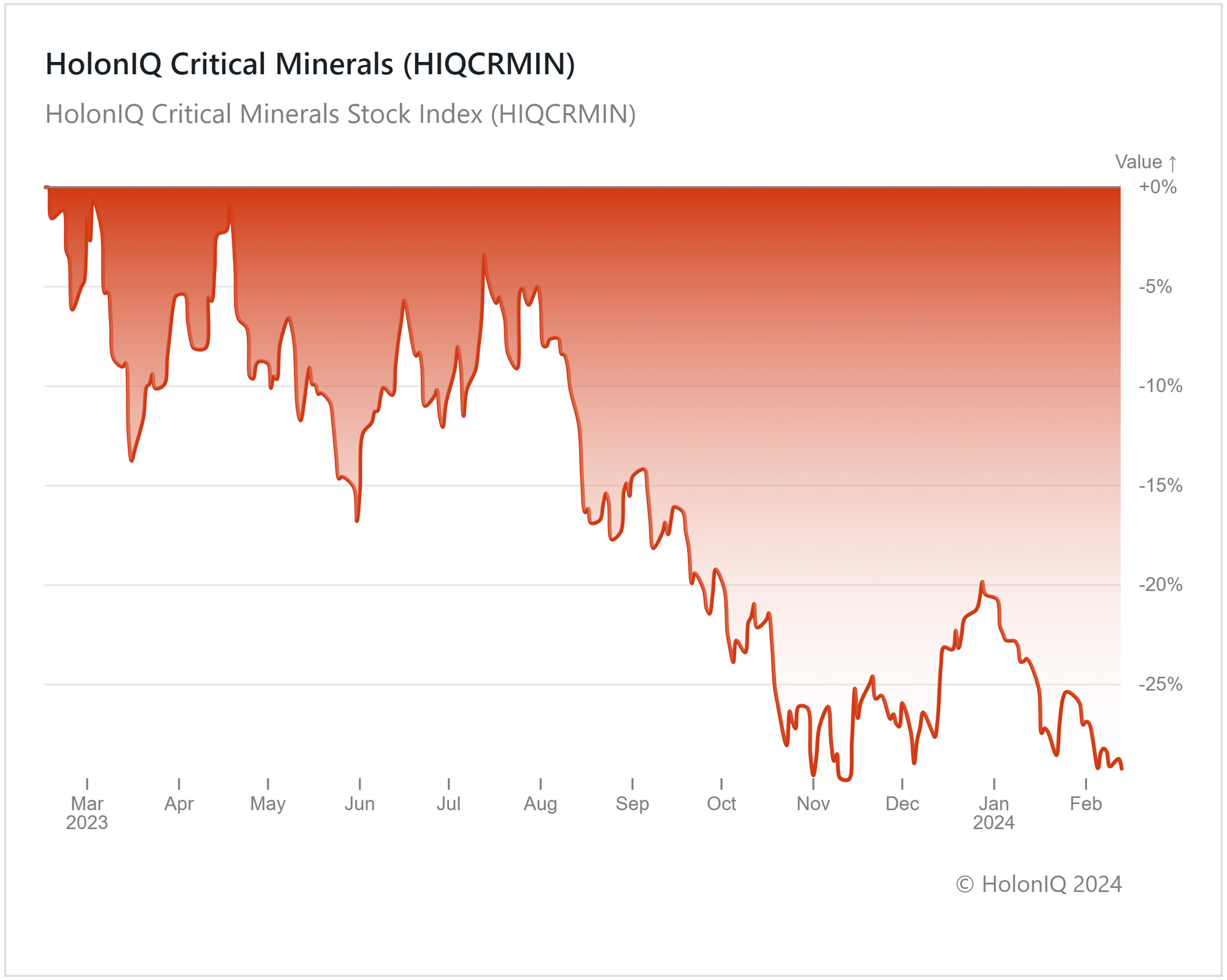

- 🪨 Critical Minerals. Critical Minerals Stock Index Down 29%.

- 💰 Funding. BioAge Raises $170M, Dermatology, Cancer Therapeutics, Climate Solutions Deals + More

- 💼 M&A. Deals in Digital Publishing, Drug-Free Sport, Orthopedic + More

- 📅 Economics. Major Retail Sales Data, Inflation Data, Balance of Trade Data, UK GDB Data + More

For unlimited access to more deals and economic updates, request a demo

🪨 Critical Minerals Index Down 29%

HolonIQ’s Critical Minerals index is down 29% over the last 12 months. Major stocks have seen declines, dragging the index down. BHP Group Ltd (Market Cap: US$ 153B) returned -12.3% YoY, Glencore Plc (Market Cap: US$ 60B) saw -24% returns YoY, while Freeport-McMoRan, Inc. (Market Cap: US$ 54B) was down by 15%.

China’s recent economic contraction has played a part in the decline. The significant slowdown in the EV market as a result of China’s weakened economy, has dampened the demand for batteries. Many critical minerals are crucial raw materials in EV battery production, and have felt the effects of this lower demand. Lower construction stemming from China's property slump is also expected to impact the demand for Iron Ore, which is predominantly used in making steel.

However, with critical minerals being an essential component in clean energy, a sector that is rapidly growing in significance, and as global uncertainty continues to wane, a longer-term positive outlook is plausible for the sector.

💰 Funding

💊 BioAge Labs, a California-based biotech company that develops therapeutics to treat metabolic diseases, raised $170M Series D from Sofinnova Investments to move its drug candidate into a Phase II trial.

🩸 ProfoundBio, a Washington-based Antibody-Drug Conjugate (ADC) cancer therapeutics biotech, raised a $112M Series B from Ally Bridge Group to advance its Clinical-Stage ADC Pipeline.

🔬 Areteia Therapeutics, a New Jersey-based biotechnology company, raised a $75M Series A from Bain Capital Life Sciences to support the expansion of the current Phase III development program of Dexpramipexole in eosinophilic asthma.

💊 Sudo Biosciences, an Indiana-based biopharmaceutical company, raised a $30M Series B from Enavate Sciences and TPG. This funding will be used to advance two precision TYK2 inhibitors into clinical trials for MS, psoriasis, and severe autoimmune/neurological conditions.

🐾 Supertails, a digital platform for pet care in India, raised a $15M Series B from RPSG Capital Ventures to enable business growth.

🌍 Rimere, a California-based company specializing in climate solutions, raised $10M in a corporate round from Clean Energy Fuels Corp. This funding will accelerate the deployment of Rimere’s two devices, the Reformer and the Mitigator.

⚡ Camus Energy, a California-based grid orchestration platform provider, raised a $10M Series A from Wave Capital and Congruent Ventures to enable grid operators to support booming electricity demand.

🌬️ Aegir Insights, a Danish provider of software, data, and intelligence for offshore wind investors, raised a $9.1M Series A funding from Seaya to accelerate offshore wind investments.

💼 M&A

🎓 SchoolStatus, a Mississippi-based provider of K-12 data-driven solutions that empower student success, acquired SchoolNow, an Ohio-based unified digital publishing platform for K-12, that streamlines how schools engage families and their communities.

🏋️♂️ CPC, a Missouri-based company formed to buy, build, and hold businesses with a long-term horizon, acquired Drug-Free Sport International (DFSI), a global leader in anti-doping and athlete health, headquartered in Missouri.

🦴 Zeda, a California-based global leader in innovative healthcare solutions, acquired The Orthopaedic Implant Company (OIC), a Nevada-based orthopedic implant company recognized as the leader in value-based implants.

💊 Soaak Technologies, a California-based pioneering name in health-tech innovation, acquired Tulsa Natural Health Clinic, an Oklahoma-based naturopathic-functional medicine specialist.

🔋 TRIG, a Guernsey-based leading renewable energy investment company, acquired Fig Power, a UK-based energy projects developer specializing in battery storage.

📅 Economic Calendar

Major Retail Sales Data, Inflation Data, Balance of Trade Data, UK GDB Data + More

Thursday February 15th 2024

🇯🇵 Japan GDP Data , Q4

🇬🇧 UK GDP Data , Q4

🇬🇧 UK GDP Data, December

🇺🇸 US Retail Sales Data , January

Friday February 16th 2024

🇬🇧 UK Retail Sales Data, January

🇺🇸 US Building Permits Prel, January

🇺🇸 US PPI MoM, January

🇺🇸 US Michigan Consumer Sentiment Prel, February

Tuesday February 20th 2024

🇦🇺 Australia RBA Meeting Minutes

🇨🇦 Canada Inflation Data, January

Wednesday February 21st 2024

🇯🇵 Japan Balance of Trade, January

Thursday February 22nd 2024

🇺🇸 US FOMC Minutes

🇩🇪 Germany HCOB Manufacturing PMI Flash, February

Friday February 23rd 2024

🇩🇪 Germany Ifo Business Climate, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com