🩺 $500M+ VC Funding. Health Diagnostics Index Rebounds From 15% Drop.

Impact Capital Markets #33 looks at our Diagnostics and Testing stock index, major impact deals, M&A, and upcoming economic releases.

Bula🌴

📉 Today's Global Economic Update: Japan's January 2024 trade data, released today, revealed a significant reduction in the trade deficit, with exports rising by 11.9% YoY to JPY 7.3T. Imports fell by 9.6% to JPY 9T, marking the 10th consecutive month of decline, driven by reduced energy prices.

🔋 Deal of the Day: Ascend Elements, a battery materials recycler, raised $162M in Series D funding to convert lithium-ion batteries into critical materials.

What's New?

- 🔬 Health Diagnostics and Testing. Health Diagnostics Index recovers from 15% loss

- 💰 Funding. Ascend raises $162M, cardiovascular care, maternity care deals + more

- 💼 M&A. Recycling, K-12, satellite & health insurance

- 📅 Economics. Major inflation data, balance of trade, US GDP growth data + more

For unlimited access to more deals and economic updates, request a demo

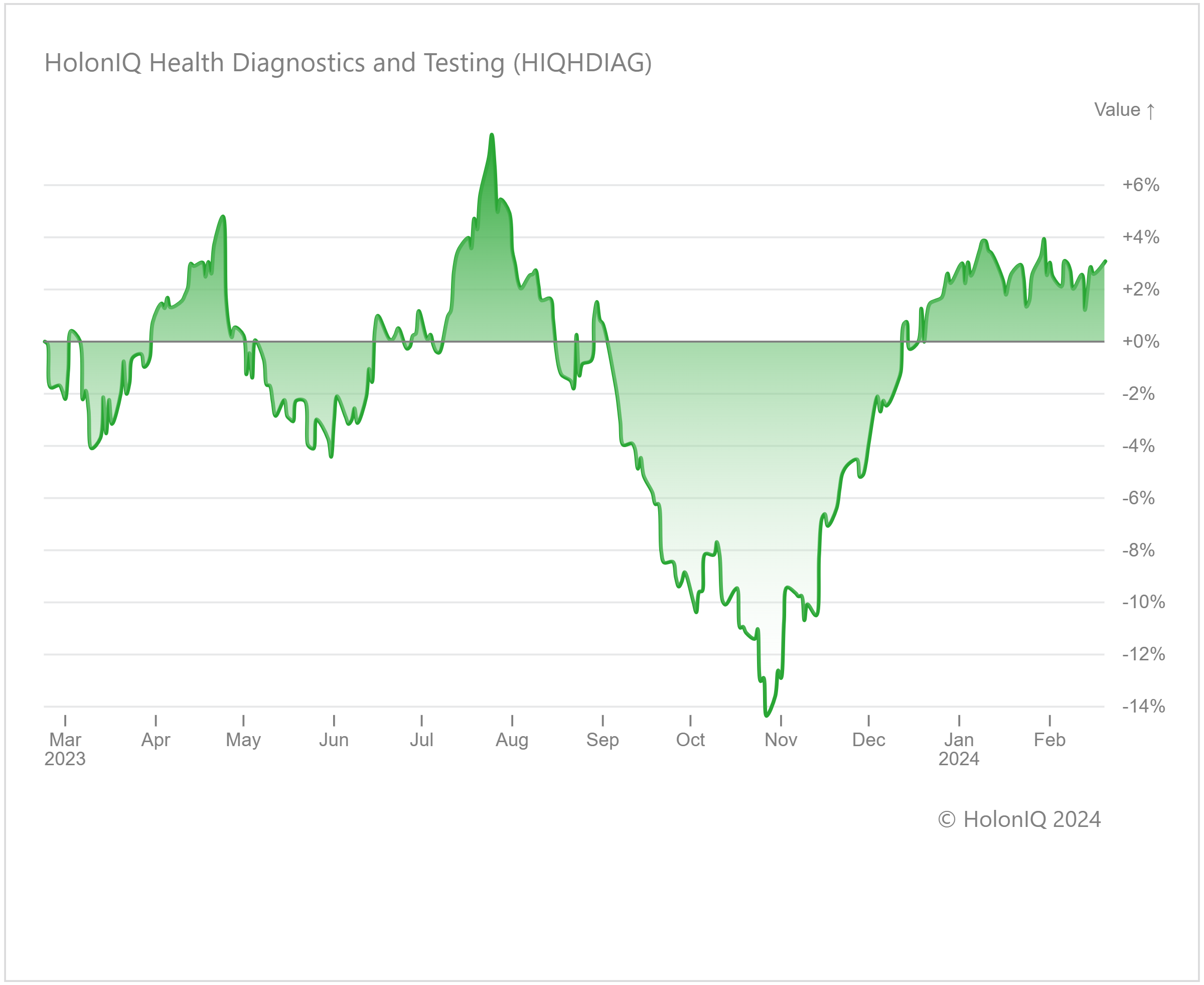

🔬 Health Diagnostic Index Recovers From 15% Loss

HolonIQ’s Health Diagnostics and Testing Index recovered from a 15% loss in 4Q 2023 to record a 3% growth in February. Several stocks in the group saw relatively strong returns, including Abbott Laboratories (MCap: US$ 202B) and Danaher Corp. (MCap: US$ 183B), which increased by 13% and 11%, respectively. However, a few major stocks within the index saw declining returns. Roche Holding AG (MCap: US$ 218B) fell 15% YoY as 2023 profits slumped amidst a post-COVID loss of sales while Thermo Fisher Scientific (MCap: US$ 211B) also saw a minor decline.

As patient awareness of diagnostic services increases and technological advancements are incorporated into testing, diagnostics are expected to assume a progressively central role in influencing healthcare outcomes. The introduction of new technologies has also brought about self-diagnostic capabilities while the growing use of diagnostics outside conventional hospital and healthcare environments opens up new possibilities, contributing to the ongoing growth of the sector.

💰 Funding

🔋 Ascend Elements, a Massachusetts-based sustainable battery materials recycler, raised a $162M Series D to build sustainable lithium-ion battery materials in the US.

🤖 Recogni, a California-based leader in AI-based computing, raised a $102M Series C from GreatPoint Ventures & Celesta Capital to advance next-generation AI inference systems for generative AI.

🫀 Reprieve Cardiovascular, a Massachusetts-based company focused on intelligent fluid management for heart failure, raised a $42M Series A from Sante Ventures & Lightstone Ventures to enhance its clinical and development programs.

🧬 Bioptimus, a France-based biomedical analytics company, raised a $35M Seed from Sofinnova Partners to build the first universal AI foundation model for biology.

👶 Oula Health, the first modern maternity care clinic combining obstetrics and midwifery care in New York, raised a $28M Series B to expand tech-enabled hybrid care beyond NYC.

🧲 Niron Magnetics, a Minnesota-based provider of rare earth-free permanent magnets, raised $25M from Samsung Ventures to expand its production facilities and scale manufacturing capacity.

⚕️ AZmed, a France-based healthcare AI solutions provider, raised a $16.16M Series A with the objective of shaping the future of medical imaging with AI.

💉 Baseimmune, a UK-based vaccine discovery biotech, raised $11.35M to develop ‘mutation-proof’ vaccines.

🌱 Trace Genomics, a California-based industry leader in DNA-based soil intelligence, raised a $10.5M Series B to expand its commercial growth.

🏥 9amHealth, a California-based virtual provider of cardiometabolic healthcare services, raised a $9.5M Series A from Cigna Ventures to expand operations.

💼 M&A

🔄 IFCO Systems NV, a Netherlands-based provider of reusable packaging containers, acquired BEPCO, an Estonian supply and storage company that provides transport packaging recycling services.

🛡️ Inszone Insurance Services, a California-based full-service insurance firm, acquired Financial Arts, an Indiana-based employee benefits and insurance service provider.

📚 Unleashed Brands, a Texas-based innovative brand that operates a youth enrichment platform, acquired Sylvan Learning, a Maryland-based provider of supplemental and enrichment education for K-12 students.

🛰️ NUVIEW, a Florida-based earth observation and geospatial technology company building the world's first commercial LiDAR satellite constellation, acquired Astraea, a Virginia-based satellite imagery analytics company.

📅 Economic Calendar

Major Inflation Data, Balance of Trade, US GDP Growth Data + More

Thursday, February 22nd 2024

🇺🇸 US FOMC Minutes

🇩🇪 Germany HCOB Manufacturing PMI (Preliminary), February

Friday, February 23rd 2024

🇩🇪 Germany Ifo Business Climate, February

Tuesday, February 27th 2024

🇯🇵 Japan Inflation Data, January

🇩🇪 Germany GfK Consumer Confidence, March

🇺🇸 US Durable Goods Orders Data, January

Wednesday, February 28th 2024

Thursday, February 29th 2024

🇫🇷 France Inflation Data (Preliminary), February

🇮🇳 India GDP Data, Q4

🇩🇪 Germany Inflation Data (Preliminary), February

🇨🇦 Canada GDP Data, Q4

🇺🇸 US Core PCE Price Index Data, January

🇺🇸 US Personal Income & Spending Data, January

Friday, March 01st 2024

🇨🇳 China NBS & Caixin Manufacturing PMI (Preliminary), February

🇯🇵 Japan Consumer Confidence, February

🇪🇦 Euro Area Inflation Data (Flash), February

🇮🇹 Italy GDP Data, 2024

🇮🇹 Italy Inflation Data (Preliminary), February

🇮🇹 Italy Government Budget, 2023

🇺🇸 US ISM Manufacturing PMI (Preliminary), February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com