🌿 $233M Clean Tech Funding. Airports Recover 17% Loss.

Impact Capital Markets #43 looks at our Airports stock index, major impact deals, M&A, and upcoming economic releases.

Namaskār 🏔️

📉 Today's Global Economic Update: Australia's Q4 2023 GDP data released today, showed a modest 0.2% expansion Quarter-on-Quarter, the slowest in five quarters. Despite restrained consumer spending and reduced government expenditure, the annual GDP growth of 1.5% slightly surpassed forecasts, indicating resilience amid economic challenges and the potential for a gradual recovery ahead.

🌿 Deal of the Day: Sunfire, a German clean hydrogen company, raised a $233M Series E to scale up its green hydrogen production technology.

What's New?

- 🛫 Airports. Airports index recovers 17% loss

- 💰 Funding. Cleantech, dental AI, medical devices & more

- 💼 M&A. HR, workplace learning, consulting & more

- 📅 Economics. ECB interest rate decision, UK GDP, US inflation + more

For unlimited access to more deals and economic updates, request a demo

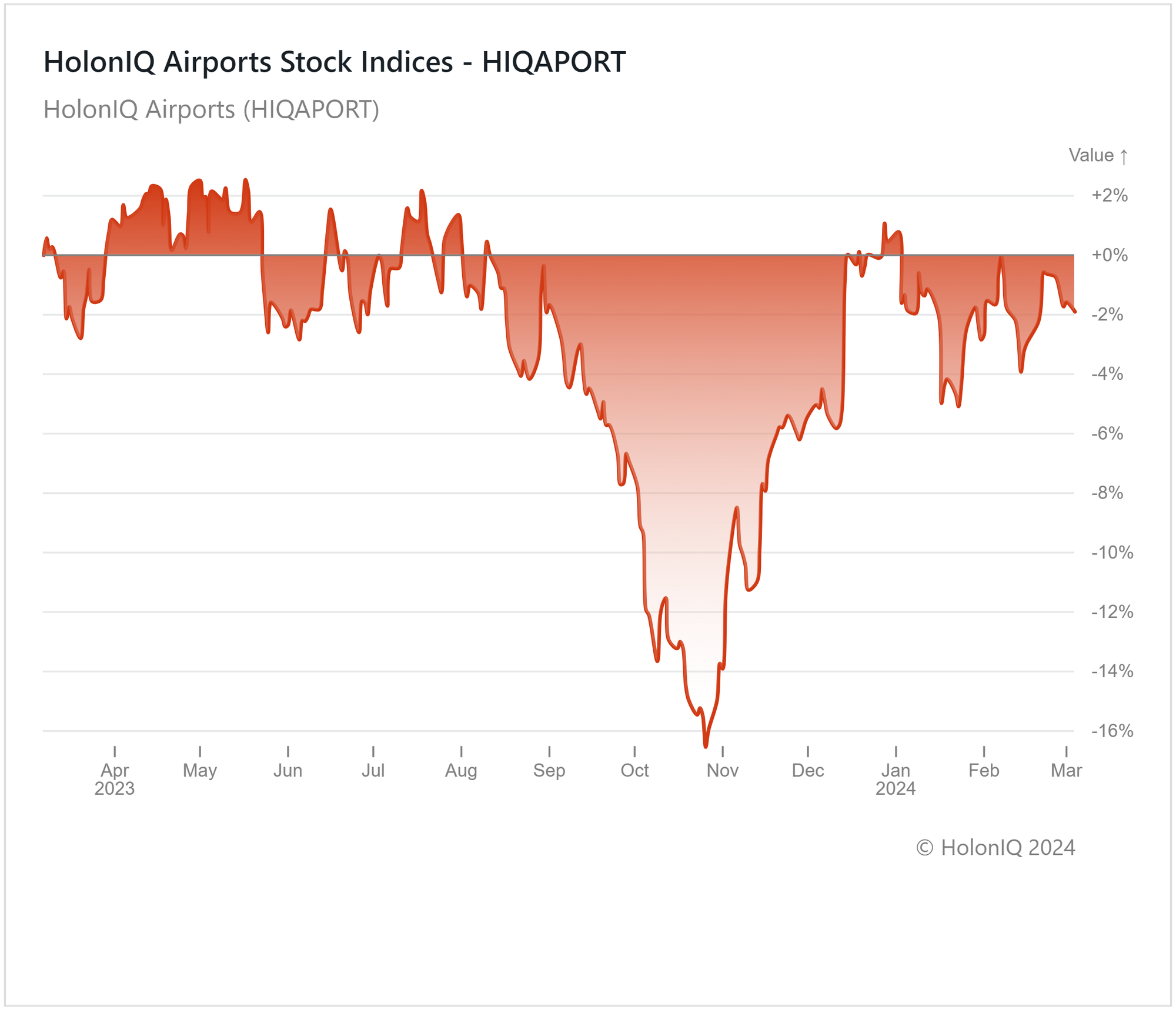

🛫 Airports Recover 17% Loss

The past year has been challenging for the aviation sector, with HolonIQ's Airports Index dropping 17%, reaching its lowest point in October 2023. The index is recovering, having now improved to a 2.5% contraction compared to a year ago. Major constituents like Airports of Thailand Public Co. Ltd. ($26B MCap) and Aéroports de Paris ($13.5B MCap) saw prices slump by 10.5% and 8.5%, respectively, while Aena S.M.E. SA ($28B MCap) experienced substantial growth at 18.8% Year-on-Year.

Airport stocks are declining due to rising tensions in the Middle East, which is leading to higher fuel costs and volatility in prices. Additionally, factors like supply chain issues and uncertainty about the economy are contributing to the downturn. However, amidst these challenges, there are indications of a gradual recovery as more people begin to travel again, reflecting a positive shift in consumer confidence and demand for air travel services.

💰 Funding

🌿 Sunfire, a German manufacturer of electrolyzers, raised a $233M Series E to scale up its green hydrogen production technology.

🚨 RapidSOS, a NYC-based startup that uses AI to help emergency response teams, raised a $75M Series C to expand its operations.

🦷 Overjet, a Massachusetts-based company creating AI solutions for dentalcare, raised a $53.2M Series C from March Capital to expand its AI platform.

🔬 Vivolight, a Chinese medical device company, raised $13.8M from Sinowisdom to develop new products in the medical laser field.

⚡ HData, an Alabama-based startup specializing in regulatory compliance & business intelligence for the energy sector, raised a $10M Series A from Buoyant Ventures to accelerate the expansion of its platform.

🧬 Cellcolabs, a Swedish biotech company, raised $8.7M to scale up operations and business development.

🌱 Cyclize, a German climate-tech startup, raised a $5.25M Seed from UVC Partners to scale its technology.

💼 M&A

👥 Deel, a California-based payroll and compliance platform, acquired PaySpace, an African-based payroll and HR company.

🔍 ProductLife Group, a Belgium-based innovation consulting firm, acquired Health Care Solution, a Morocco-based regulatory and quality consulting firm.

📚 CIEL Group, an India-based HR solutions provider, acquired a 51% stake in Courseplay, a Mumbai-based workplace learning solutions provider, for $2M.

🧪 Indutrade, a Swedish industrial valve manufacturing company, signed an agreement to acquire Matriks, a Norwegian laboratory equipment supplier.

🔬 Haemonetics, a Massachusetts-based medical technology company, entered into an agreement to acquire Attune Medical, an Illinois-based medical device provider.

📅 Economic Calendar

ECB Interest Rate Decision, UK GDP, US Inflation + More

Wednesday, March 6th 2024

🇩🇪 Germany Balance of Trade, January

🇨🇦 Canada BoC Interest Rate Decision

🇨🇦 Canada Ivey PMI s.a, February

🇺🇸 US JOLTs Job Openings, January

Thursday, March 7th 2024

🇦🇺 Australia Balance of Trade, January

🇨🇳 China Balance of Trade, Jan-Feb

🇪🇦 ECB Interest Rate Decision

🇨🇦 Canada Balance of Trade, January

Friday, March 8th 2024

🇨🇦 Canada Unemployment Data, February

🇺🇸 US Non-Farm Payrolls, February

🇺🇸 US Unemployment Data, February

Tuesday, March 12th 2024

🇦🇺 Australia NAB Business Confidence, February

🇬🇧 UK Unemployment Data, January

🇺🇸 US Core Inflation Data, February

🇺🇸 US Inflation Data, February

Wednesday, March 13th 2024

Thursday, March 14th 2024

🇺🇸 US PPI Data, February

🇺🇸 US Retail Sales Data, February

Friday, March 15th 2024

🇺🇸 US Michigan Consumer Sentiment (Preliminary), March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com