💊 $1B Pharma Acquisition. Coal Index Increases.

Impact Capital Markets #50 looks at our Coal stock index, major impact deals, M&A, and upcoming economic releases.

Zdravo 🏰

📉 Today's Global Economic Update: The US Producer Price Index for February 2024 increased by 0.6% on a month-on-month basis. Prices for final demand goods rose by 1.2%, led by higher energy and food costs, while services saw a 0.3% increase. Year-on-year, the index saw its most significant increase since September 2023 (1.6%), indicating ongoing inflationary pressures.

💊 Deal of the Day: AstraZeneca has entered into a definitive agreement to acquire Amolyt Pharma for $1.05B.

What's New?

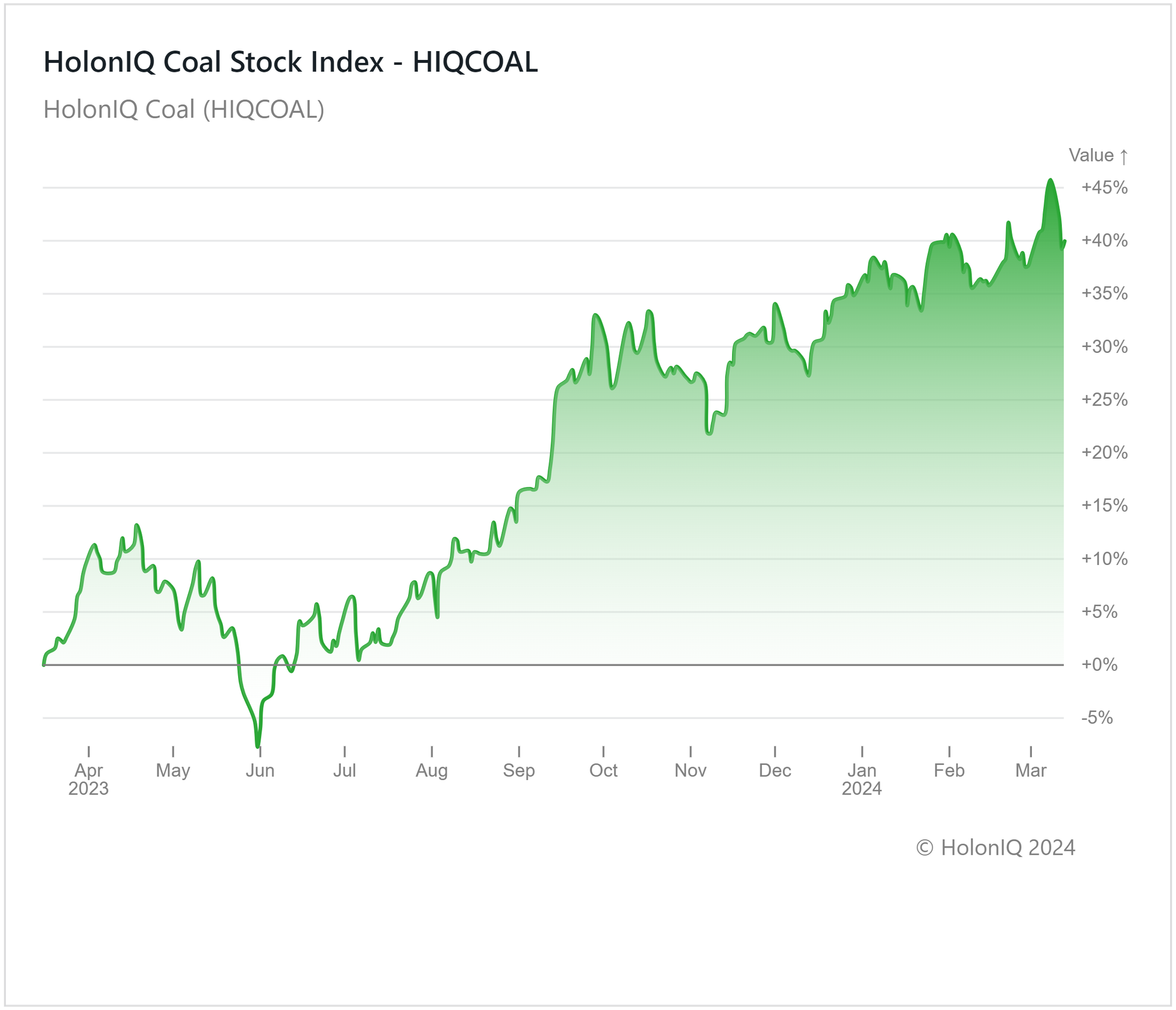

- 🪨 Coal. Coal index increases 40%

- 💰 Funding. Biotech, gastro tech, carbon utilization & more

- 💼 M&A. Pharmaceuticals & language service providers

- 📅 Economics. Major interest rate decisions, retail sales data, inflation + more

For unlimited access to more deals and economic updates, request a demo

🪨 Coal Index Increases 40%

While there is a global shift towards renewable energy, developed countries are generally ahead of developing countries in this transition. Financial constraints have hindered the rapid adoption of renewable energy in emerging and developing economies, which continue to drive the majority of coal demand. This trend is evident in the 40% increase observed in HolonIQ’s Coal Index over the past year. Major stocks in the index have risen, including China Shenhua Energy ($98B MCap) and Teck Resources ($23B Mcap), which recorded returns of 24% and 31%, respectively. The Indian government has also underscored this trend, stating that it will continue to secure more fossil fuel reserves due to their affordability and availability.

Severe droughts in Asian countries have decreased hydropower generation, leading to an increased reliance on coal as an alternative power source, offsetting declines in demand from Europe and North America. China, which is leading the charge in increasing renewable energy capacity, also maintains over 50% of coal demand, shaping the outlook of the coal industry. The International Energy Agency anticipates that the significant growth of renewable energy capacity in the coming years will decrease global coal demand, including in China, by 2026, even without governments enforcing stronger clean energy and climate policies.

💰 Funding

💉 Tubulis, a German biotech company, raised a $138.8M Series B from Nextech Invest & EQT Life Sciences to advance its pipeline of drugs developed for treating solid tumors.

🩺 HiLabs, a Maryland-based health data analytics platform, raised a $39M Series B from Eight Roads Ventures & Denali Growth Partners to expand its team and support tech developments.

🧬 Asgard Therapeutics, a Swedish biotechnology Company, raised a $33M Series A from RV Invest & Johnson & Johnson Innovation to support operations and expand its R&D team.

💊 Mission Therapeutics, a UK-based drug development company, raised $32M to accelerate the development of its lead drug candidates, which aim to treat diseases including Parkinson's and heart failure.

🔬 Pi Health, a Massachusetts-based clinical research company, raised a $30M Series A from AlleyCorp and Obvious Ventures to expand its partnerships with global clinical trial sites and life sciences companies.

🍽️ NeoTaste, a German app developer linking restaurants with customers, raised a $16.5M Series A from Earlybird Venture Capital to support its expansion into European markets.

🌱 Carbonova, a Canadian startup that aims to turn greenhouse gas emissions into usable carbon materials, raised a $6M Seed from Kolon Industries to build Canada's first commercial carbon nanofiber unit.

👵 Kites Senior Care, an Indian geriatric care service provider, raised a $5.4M Series A from Ranjan Pai to facilitate expansion into more Indian cities.

🌊 MarineLabs, a Canadian data analytics firm, raised a $4.5M Seed from BDC Capital’s Sustainability Venture Fund to accelerate product development.

💼 M&A

💊 AstraZeneca has entered into a definitive agreement to acquire Amolyt Pharma, a French biopharmaceutical company, for up to $1.05B.

🗣️ thebigword Group, a UK-based language service provider, acquired Clarion Housing Group, a British Sign Language (BSL) service provider in the UK.

📅 Economic Calendar

Major Interest Rate Decisions, Retail Sales Data, Inflation + More

Friday, March 15th 2024

🇺🇸 US Michigan Consumer Sentiment Index (Preliminary), March

Monday, March 18th 2024

🇨🇳 China Industrial Production Data, Jan-Feb

🇨🇳 China Retail Sales Data, Jan-Feb

Tuesday, March 19th 2024

🇯🇵 Japan BoJ Interest Rate Decision

🇦🇺 Australia RBA Interest Rate Decision

🇩🇪 Germany ZEW Economic Sentiment Index, March

🇺🇸 US Building Permits Data (Preliminary), February

🇨🇦 Canada Inflation Data, February

Wednesday, March 20th 2024

🇬🇧 UK Inflation Data, February

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

Thursday, March 21st 2024

🇺🇸 US Fed Press Conference

🇯🇵 Japan Balance of Trade Data, February

🇩🇪 Germany HCOB Manufacturing PMI (Flash), March

🇬🇧 UK BoE Interest Rate Decision

Friday, March 22nd 2024

🇯🇵 Japan Inflation Data, February

🇬🇧 UK Retail Sales Data, February

🇩🇪 Germany Ifo Business Climate Index, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com