💰 $145M Lithium Tech Funding. Nutrition Index Bounces Back.

Impact Capital Markets #27 looks at our Nutrition & Supplements Index, major impact deals and acquisitions, and the upcoming economic releases.

Guten Tag 👋

📉 Today's Global Economic Update: Today's release of UK unemployment data reveals that in Q4 2023, the unemployment rate fell to 3.8%, marking its lowest since February-April 2023, with 87K fewer unemployed individuals at 1.32M. Full-time employment surged by 72K to 33.17M, while part-time employment experienced a decline.

🪨 Deal of the Day: Lilac Solutions raised $145M in Series C for global expansion.

What's New?

- 💊 Nutrition & Supplements. Nutrition Index Bounces Back from 14% Dip

- 💰 Funding. Lilac Raises $145M, Dermatology, Aviation, Medical Device Deals + More

- 💼 M&A. $26B Diamondback & Endeavor Merger, Acquisitions in Clinical Research & Insurance

- 📅 Economics. Major Employment Data, Inflation Data, UK GDB Data + More

For unlimited access to more deals and economic updates, request a demo

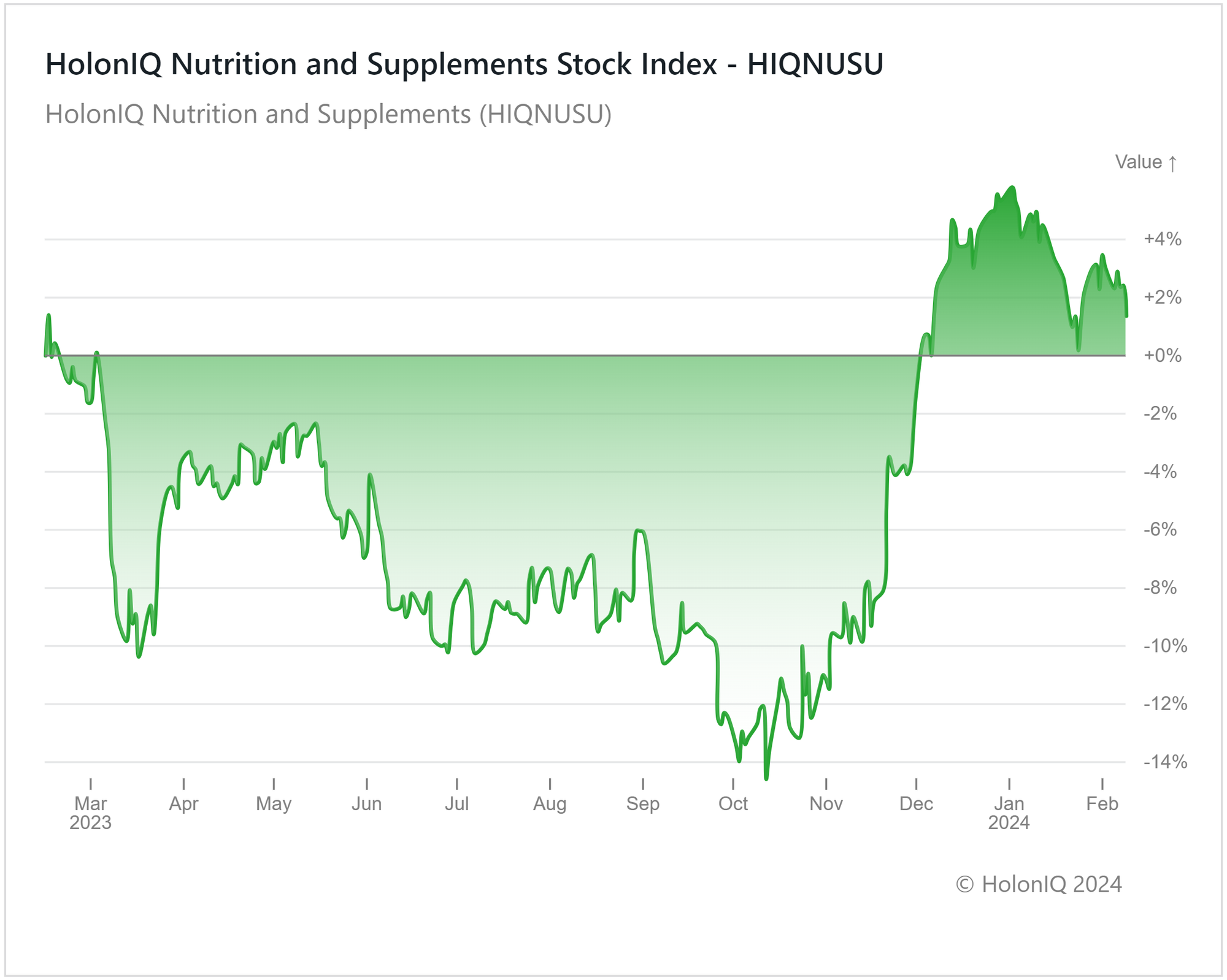

💊 Nutrition Index Bounces Back from 14% Dip

HolonIQ’s Nutrition and Supplements index is up by 2% from a year ago, recovering from a 14% decline in October 2023. The index's modest gains reflect varied returns across the spectrum encompassing major stocks such as Nestle (-13% YoY) and BellRing Brands (+93% YoY). The industry has suffered from higher input costs which began during the pandemic, and was worsened by the Russia-Ukraine war. A lack of raw materials and labor shortages likely hampered the industry’s growth, however supplement demand is on the rise.

An increasing focus on nutrition and a balanced lifestyle is driving the market, whilst fertility supplements are also becoming increasingly popular as infertility awareness grows. The aging population has also increased demand for bone health and energy supplements. With various product innovations, from gummies to texturized vegetable powder, demand is likely to keep expanding.

💰 Funding

🪨 Lilac Solutions, a California-based lithium extraction technology company, raised a $145M Series C to expand its ion-exchange material production and global deployment.

💊 Alys Pharmaceuticals, a Massachusetts-based immuno-dermatology-focused company, raised a $100M Seed from Medicxi to advance their Immuno-Dermatology-focused pipeline.

✈️ Velocys, a Texas-based sustainable aviation fuel technology company, raised $40M to boost tech delivery, scale production, and enrich team expertise.

🎓 AmberStudent, an India-based student accommodation platform, raised $18.5M from Gaja Capital to enhance its offerings for property managers and students.

🌿 MeduSoil, a Swiss-based manufacturer of sustainable materials, raised a $5.9M Seed to expand operations in Switzerland and Europe.

💵 Mia Share, a Wyoming-based payment solution for trade and technical schools, raised a $6.5M Seed from TTV Capital to improve tuition management and payments.

💉 BRIJ Medical, a Georgia-based medical device manufacturer, raised a $5.5M Seed from Tim Gleeson. The funds will be used for further product development and commercial rollout of its incision and scar management system.

🤖 TORTUS AI, a UK-based healthcare AI technology company, raised a $4.2M Seed from Khosla Ventures to speed up medical admin with AI assistant.

💼 M&A

⛽ Diamondback Energy, a Texas-based independent oil and natural gas company and Endeavor Energy Resources, an exploration and production company in Texas, have entered a definitive merger agreement. The transaction is valued at approximately $26B.

🔬 Sentrex Health Solutions, a leading provider of specialty healthcare services in Canada, acquired PerCuro Clinical Research, one of Canada's premier providers of infusion services, clinical research, and advanced nursing care.

📈 Arthur J. Gallagher & C, an Illinois-based global insurance brokerage and consulting services firm, acquired Simply-Communicate Ltd, a UK-based workplace communication agency.

📅 Economic Calendar

Major Employment Data, Inflation Data, UK GDB Data + More

Tuesday , February 13th 2024

🇩🇪 Germany ZEW Economic Sentiment Index, February

🇺🇸 US Core Inflation Data , January

🇺🇸 US Inflation Data , January

Wednesday February 14th 2024

Thursday February 15th 2024

🇯🇵 Japan GDP Data , Q4

🇬🇧 UK GDP Data , Q4

🇬🇧 UK GDP Data, December

🇺🇸 US Retail Sales Data , January

Friday February 16th 2024

🇬🇧 UK Retail Sales Data, January

🇺🇸 US Building Permits Prel, January

🇺🇸 US PPI MoM, January

🇺🇸 US Michigan Consumer Sentiment Prel, February

Tuesday February 20th 2024

🇦🇺 Australia RBA Meeting Minutes

🇨🇦 Canada Inflation Data, January

Wednesday February 21st 2024

🇯🇵 Japan Balance of Trade, January

Thursday February 22nd 2024

🇺🇸 US FOMC Minutes

🇩🇪 Germany HCOB Manufacturing PMI Flash, February

Friday February 23rd 2024

🇩🇪 Germany Ifo Business Climate, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com