✈️ 135% Increase in SAF Offtake Agreements + Southeast Asia Climate Tech 50

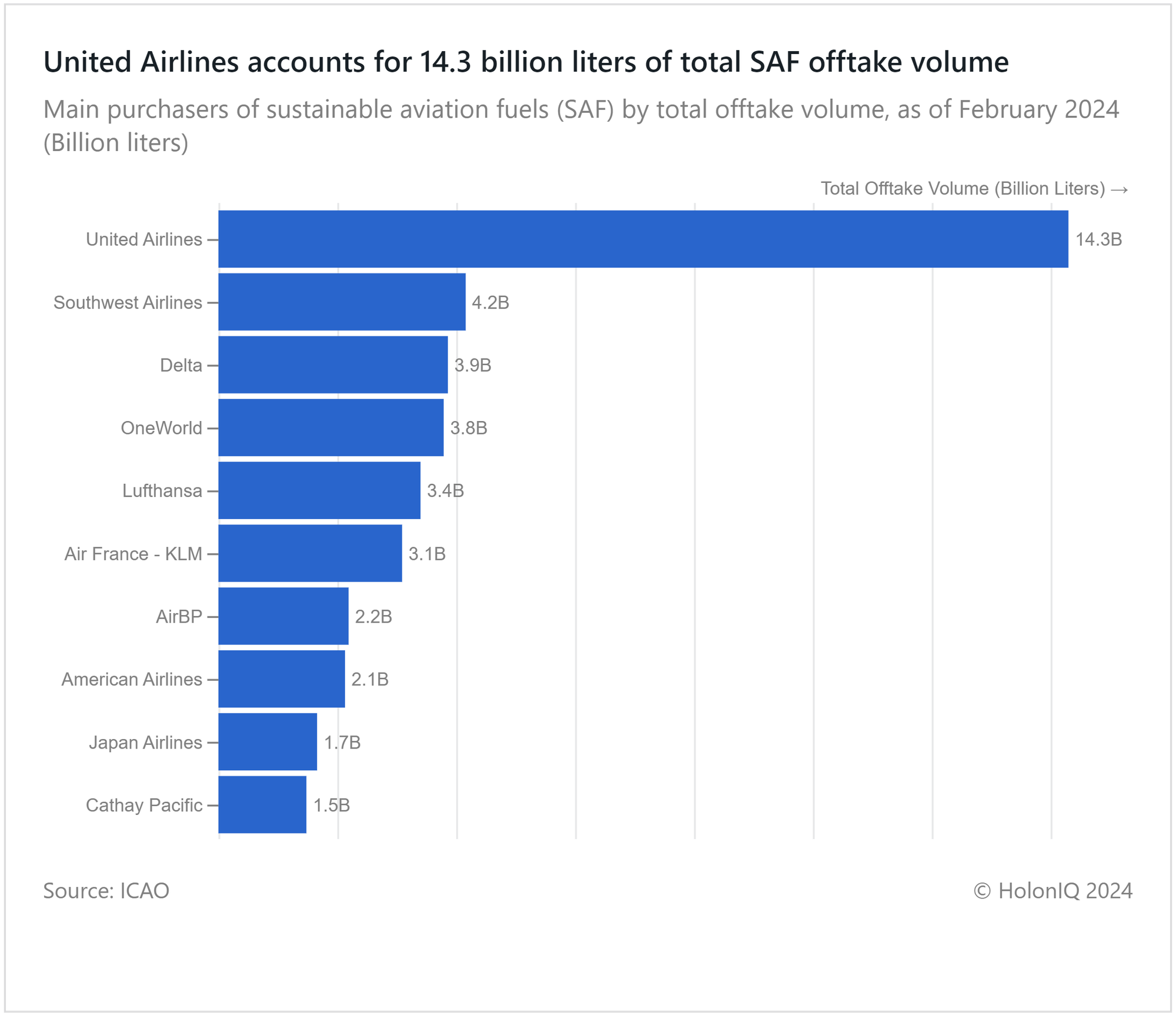

In 2022, the global volume of agreements for Sustainable Aviation Fuel (SAF) soared by 135%, reaching 21.7 billion liters. United Airlines emerged as the leader in SAF procurement, acquiring a remarkable cumulative total of 14.3 billion liters, securing its position at the forefront.

Happy Monday 👋

Global offtake agreements for Sustainable Aviation Fuel increased by 135% to reach 21.7 billion litres in 2022, with United Airlines topping the charts as the largest purchaser of SAF with a cumulative total of 14.3 billion litres. This week, we also spotlight our 2023 Southeast Asia Climate Tech 50, highlighting the region's most promising startups in the climate technology sector and how they are faring in 2024.

This Week's Topics

✈️ Sustainable Aviation Fuel. Industry landscape and mapping 100+ global players across key categories

📊 Charts Spotlight. 135% YoY increase in offtake volumes of SAF in 2022

📈 Aviation Stock Index. Index up 2% despite recent troubles

🏆 Southeast Asia Climate Tech 50. $44M of fundraising in 2024 to date

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding, M&A and IPOs

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

✈️ Sustainable Aviation Fuel (SAF) Landscape

While electric and hydrogen fuel cell aircraft are under development, SAF provides a route for immediate emission reduction from the existing fleet of jets, which are likely to serve aviation for decades to come. SAF is derived from renewable or sustainable sources, unlike traditional jet fuel made from fossil fuels. Examples of feedstocks for SAF include used cooking oil, plant and animal waste fats, biomass from non-food crops, and sustainable forestry residues. Amidst rising consumer calls and government regulations, the global aviation industry has begun shifting towards fuel blends consisting of up to 10% SAF and conventional jet fuel. The proportion of SAF will increase over the medium to long term, at a rate determined by commercial factors, and will spill over to power passenger vehicles. The announced offtake volumes of SAF in 2022 recorded a 135.6% increase from 2021, reaching a total of 21.7 billion litres.

United Airlines is the leading purchaser of SAF by total volumes at 14.3 billion litres. The second largest airline in the world based on fleet size, the company has engaged in over 10 offtake agreements. In September 2023, they signed a deal to purchase up to 1 billion gallons of sustainable aviation fuel from US-based Cemvita, which itself is the fourth largest producer in terms of offtake volume.

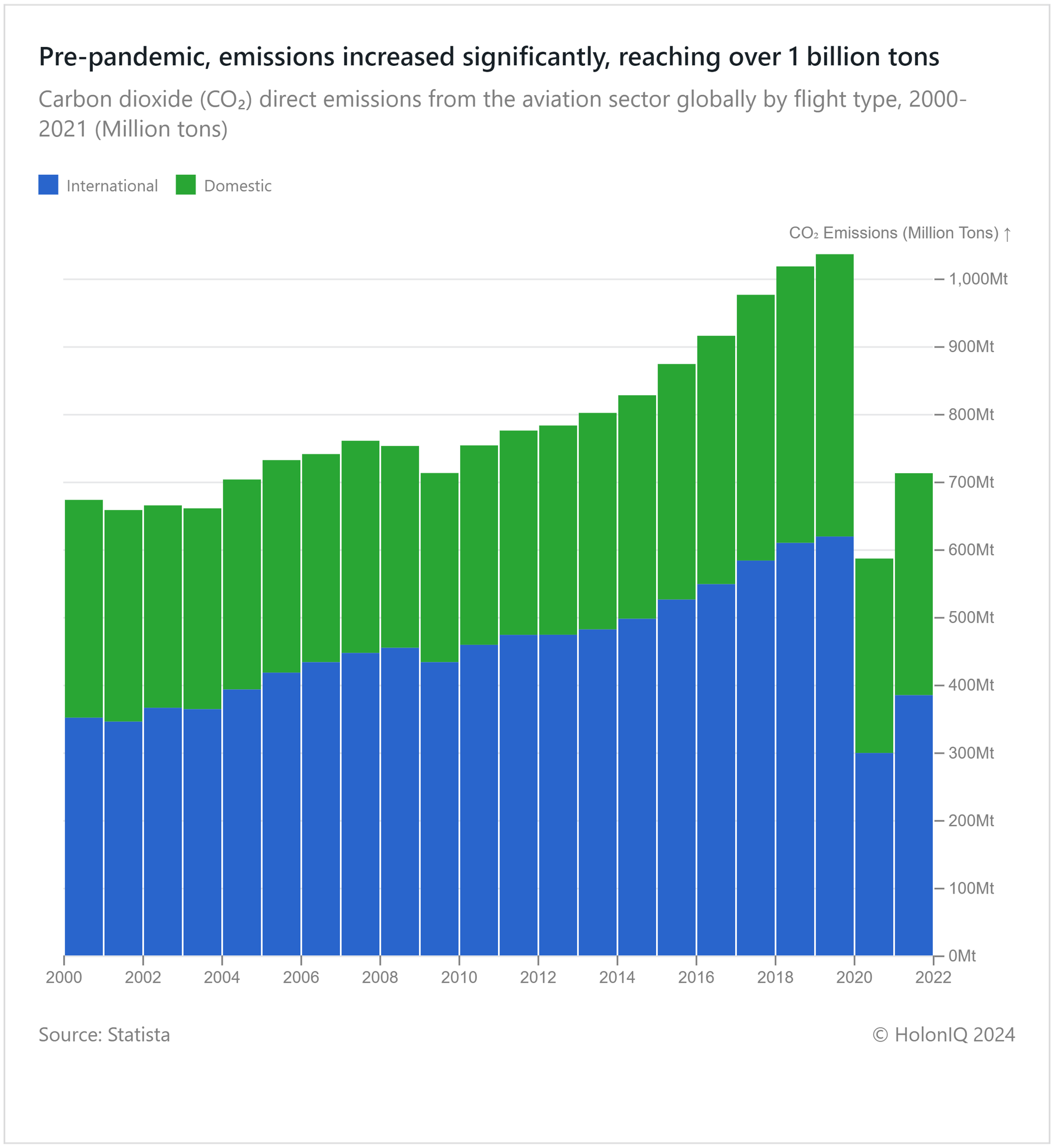

The global air travel industry accounts for 2.5% of global CO2 emissions from human activities. While this is relatively low in comparison, given the altitude at which airplanes emit greenhouse gases, it could potentially lead to a greater warming effect. In addition to CO2, aircraft also emit other pollutants like nitrogen oxides (NOx) and water vapor contrails, which can trap heat and contribute to warming. Thus, the sector's overall contribution to global warming is at around 4%. One of the industries with the fastest rate of emissions growth, its contribution to climate change is expected to rise dramatically in the upcoming decades if left unchecked.

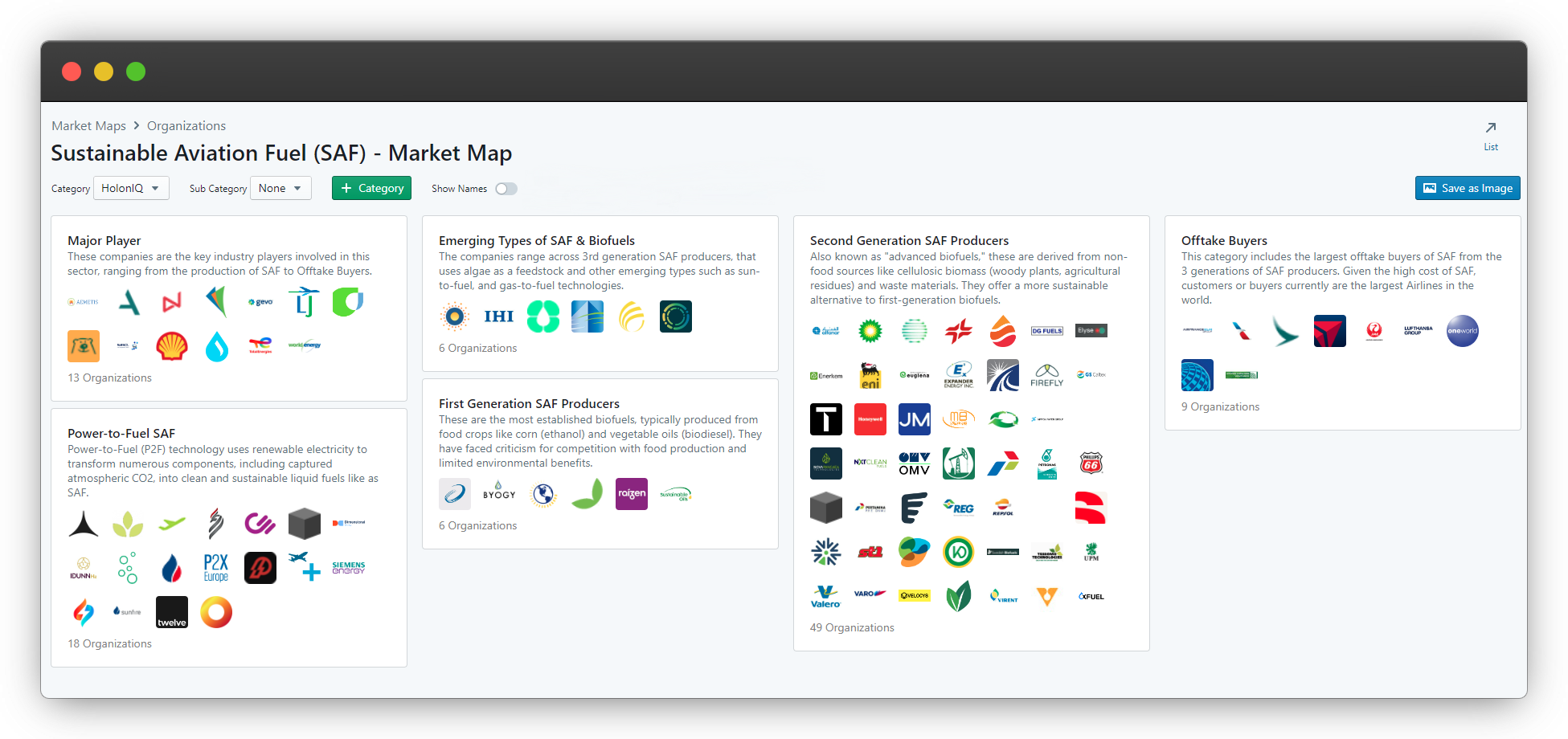

✈️ Sustainable Aviation Fuel - Market Map

The market landscape of the SAF industry is a complex and interconnected ecosystem that spans across from feedstock providers, bioreactor developers, and first and second-generation fuel producers to offtake buyers such as United Airlines. The industry is still in its early stages and concentrated in a few countries, primarily due to the high production costs involved. From the end-user perspective, SAF is priced two or three capacities higher than conventional fuel. As investments flow into the industry and companies scale up their production capacities, bolstered by technological advances, the industry is poised to see immense growth as global air travel returns to pre-pandemic levels.

📈 Capital Markets - Aviation Stock Index

HolonIQ tracks thousands of listed climate tech companies worldwide, along with acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over 10 different sectors across Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

The aviation index has experienced some volatility over the past three months but recorded more than a 2% increase. While global air travel has returned to pre-pandemic levels, recent accidents and technical issues in Boeing aircraft have affected many airlines, causing flights to be canceled. Investor confidence amidst the rising frequency of mechanical failures has dwindled, resulting in less-than-stellar stock performances. Singapore Airlines ($14B MCap) and SouthWest Airlines ($17B MCap) saw flat performance over the quarter. Delta Airlines ($30B MCap) was a notable exception, with over 10% growth over the last quarter. The airline postponed its Boeing 737 Max 10 aircraft deliveries, but its diverse fleet, including Airbus, Bombardier, and Embraer, likely mitigated the impact.

Fuel costs have also been on the rise for airlines, affecting their profitability. This is made worse by the increased adoption of costlier sustainable aviation fuels as airlines attempt to find greener alternatives. However, global air travel volume is expected to exceed pre-Covid levels in 2024 as the Asia-Pacific region makes a full recovery. Driven by sustained demand, this could make 2024 a good year for airline profits.

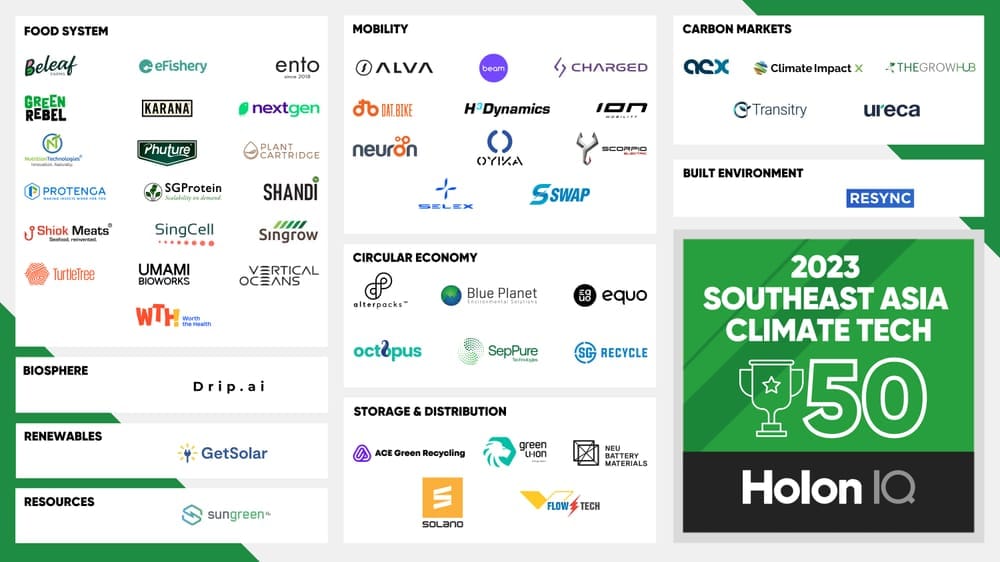

🏆 Southeast Asia Climate Tech 50

The Southeast Asia Climate Tech 50 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Climate Impact X and Swap Energi are the only two companies in Southeast Asia Climate Tech has raised funds so far in 2024. Climate Impact X, backed by Singapore's sovereign fund Temasek, raised $22.3M from Mizuho Financial Group, Standard Chartered Bank, DBS Bank, and the Singapore Exchange (SGX) while Swap Energi raised a $22M Series A led by Qiming Venture Partners, with GGV Capital and Ondine Capital.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🚗 Wayve, a UK-based autonomous driving technology company, raised a $1.1B Series C from SoftBank Group to enhance product development.

🚗 EnviroSpark, an Atlanta, Georgia-based EV charging company, raised $50M from Basalt Infrastructure Partners to broaden its proprietary network throughout the United States.

🌋 Zanskar Geothermal & Minerals, a Utah-based geothermal exploration company, raised a $30M Series B from Obvious Ventures to speed up technology development.

🌾 Superplum, an Indian agritech company, raised a $15M Series A from Erik Ragatz to streamline its supply chain.

M&A

🚁 Airbus, acquired Aerovel as the largest aircraft manufacturer targeting the fast-growing US market for low-cost attritable drones.

♻️ Repsol, a Spanish multi-energy company, acquired a 40% stake in Genia Bioenergy, a Spanish company that integrates the entire biogas and biomethane value chain.

Fund Formations

🌍 responsAbility, a Zurich-based impact investment firm, launched a new $500M climate fund focused on Asia. The funds focus areas include supporting climate resilience, regenerative agriculture, and green infrastructure projects in the region amid rising heatwaves.

💰 Eiffel Investment Group, a French-based asset management company raised $540M for its 3rd energy transition infrastructure debt program. Started in 2017, it has invested around $3B over the past seven years to finance over 3,000 renewable energy and energy efficient assets.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com