🔋 120.8% YoY Increase In BESS + Europe Climate Tech 200

The installed capacity of grid-scale battery energy storage systems (BESS) recorded a 120.8% YoY increase in 2023, with Africa and South America accounting for the largest YoY growth rates. This week, we highlight the Europe Climate Tech 200.

Happy Monday 👋

The installed capacity of grid-scale battery energy storage systems (BESS) recorded a 120.8% YoY increase in 2023, with Africa and South America accounting for the largest YoY growth rates. This week, we also spotlight the 2023 Europe Climate Tech 200, highlighting the region's most promising startups in the climate technology sector.

This Week's Topics

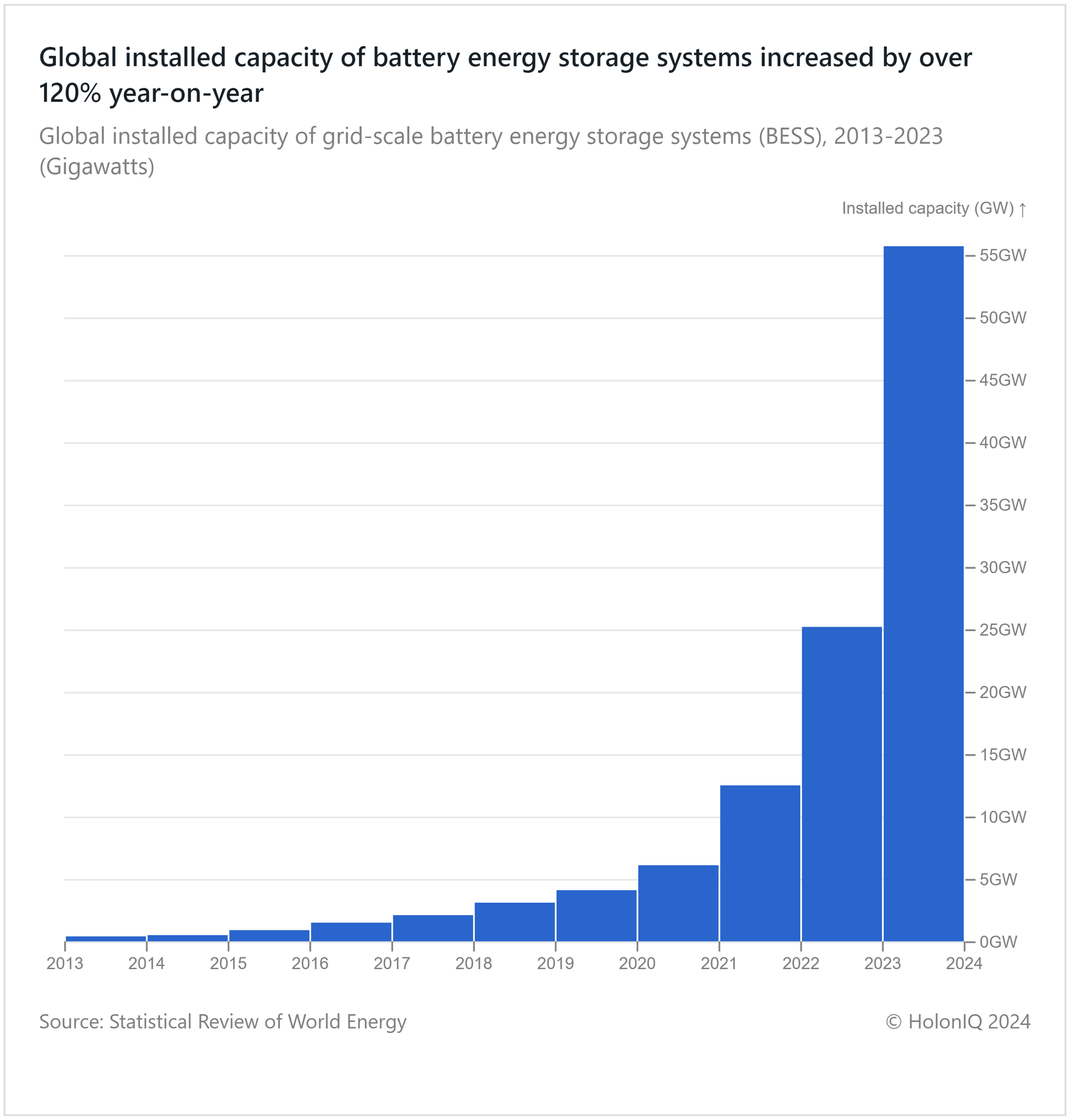

📈 Installed Capacity of BESS. 121% YoY growth in the installed capacity of battery energy storage systems

🏆 Europe Climate Tech 200. $2B worth of funding in 2024 so far

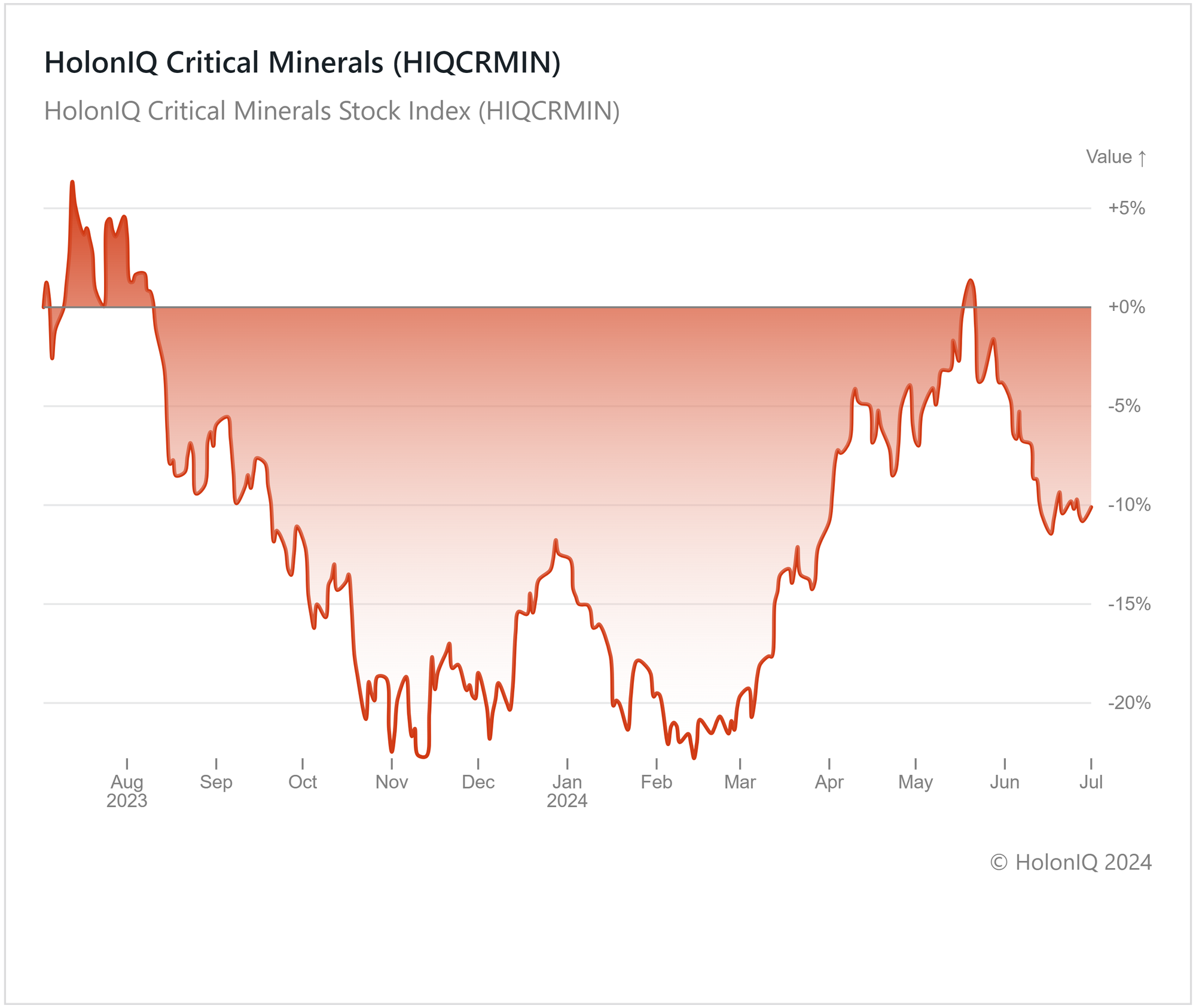

📊 Battery Tech and Lithium Stock Index. Battery tech and lithium stocks are down 5% as global EV demand slows

📝 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

📈 120% YoY Growth in Global Battery Energy Storage Systems Capacity

The global installed capacity of grid-scale battery energy storage systems (BESS) increased by over 120% from 2022 to 2023, reaching over 55 GW. BESS has shown steady growth from 2013 to 2020, followed by a significant increase starting in 2021. This rapid increase shows the growing importance of BESS in supporting renewable energy integration and enhancing grid stability. Increased funding and battery technology advancements are the growth's primary drivers.

🏆 Europe Climate Tech 200

The Europe Climate Tech 200 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Following a successful $5 billion fundraising year in 2023, the companies on the Europe Climate Tech 200 list have continued their momentum, raising approximately $2 billion in the first half of 2024. The largest to date is Enpal raising $1.2B in debt commitments to drive adoption across the German solar and heat pump market. Electra came in second raising $333M to install 2,200 EV charging stations across Europe by 2030. Easing inflation and falling interest rates in Europe are expected to create a favorable environment for deal activity in the European climate tech sector in the near term.

🪨 Critical Minerals Down 10%

The Critical Minerals Index has faced challenges over the past year, initially declining by 10% and hitting a nearly 20% low in mid-February. However, it has since rebounded with a 5% growth in the last 6 months, with the upward trend starting from late March. This recovery is reflected in major index stocks such as Freeport-McMoRan ($69B MCap), Glencore ($4B MCap), and Rio Tinto ($2.6B MCap), which have shown growth of 19%, 4%, and 3% respectively over the past 3 months.

Several factors contributed to the initial decline of the index. Shifts in market demand, including the Chinese electric vehicle market's transition to cobalt-free batteries, significantly impacted critical mineral prices. Policies like Indonesia's ban on raw nickel exports also played a role in shaping market dynamics. Despite these challenges, governments worldwide are increasingly prioritizing the development of sustainable and resilient clean energy supply chains, recognizing the pivotal role of critical minerals. Global initiatives, such as those by the US and the EU, aim to secure critical mineral supply chains. The critical minerals industry faces long-term challenges due to environmental impacts and economic sustainability issues. However, recent efforts towards industry transformation, including commitments to higher standards and sustainable practices, could indicate a path to recovery and future resilience through international cooperation and joint investment frameworks.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals across all world regions in the Climate Tech landscape. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

☀️ Xurya, an Indonesian solar energy startup, raised $55M from Norfund to expand its business and support sustainable energy transition.

✈️ Volant Aviation Technology, an eVTOL developer based in Shanghai, raised a $13 million in Series A funding to accelerate its development, production, and testing of three models of eVTOL aircraft.

⚡ Orus Energy, a French energy flexibility platform, raised a $2.3 million pre-seed round to help decarbonize the power grid.

M&A

🗄️ Flexiss Group, a UK-based self-storage development company, acquired Scott Storage, a UK-based storage solutions company.

Thank you for reading. Have a great week ahead!

Have some feedback or suggestions? Let us know at hello@holoniq.com