🧑🏫 119 Country Teacher Shortage. 2X China EVs. 10Y Bond Peaks.

Chart of the Day #12 looks at Teacher Shortages, Electric Vehicles and Treasury Bond Prices. For unlimited access to over one million charts, request a demo.

Today's Topics

- 🧑🏫 Teacher Shortages. 119 Countries to Experience Teacher Shortages.

- 🚗 Electric Vehicles. China’s Electric Vehicle Sales Double.

- 💵 Treasury Bonds. US 10Y Note Peaked in October 2023, as Fed Readies to Loosen.

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

🧑🏫 119 Countries to Experience Teacher Shortages

The prevalence of teacher shortages is increasing, with 119 countries grappling with a deficit of primary educators. Notably, Sub-Saharan Africa stands out as the region facing the most significant challenge, with 37 countries facing a deficit. In contrast, 78 countries, primarily in Latin America and the Caribbean, are expected to maintain an adequate number of primary teachers in their education systems. However, Europe and North America exhibit varied scenarios, experiencing shortages and surpluses of teachers in different regions.

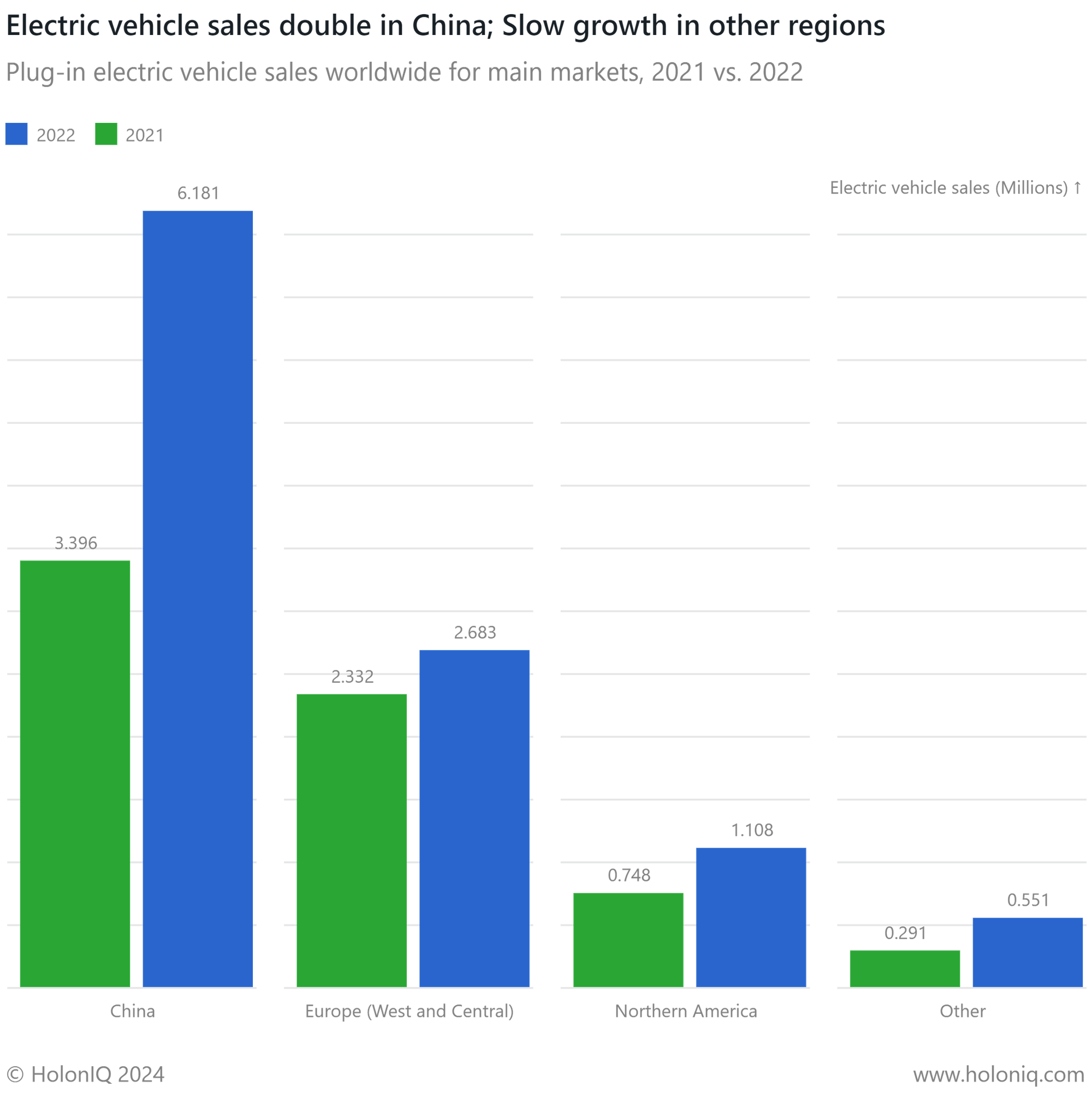

🚗 China’s Electric Vehicle Sales Double

Globally, there has been a remarkable uptick in the sales of plug-in electric vehicles. China led the charge in 2022 by achieving an impressive milestone of 6.2 million electric vehicle sales, marking an 82% YoY increase. However, Europe and North America did not match this pace, showing only 15% and 48% YoY growth, respectively.

In the EU, one of its biggest markets, elevated borrowing costs, a sluggish economy and growing pessimism around EVs are clouding the industry's growth trajectories. Sales slumped by nearly half in the region's biggest market, Germany, after EV incentives ran out, weighing on growth in other key countries. Trade tensions with China have pushed up prices, which has led to a further decrease in sales.

💵 US 10Y Note Peaked in October 2023, as Fed Readies to Loosen

The US 10-Year Treasury Note reached its highest point of the year in October 2023, at almost 5%, mirroring highs last observed in 2007. Yields have since decreased, reaching 4.1% in the fourth week of January. Bonds will likely be an in-demand asset class in 2024 as central banks prepare to ease policy. Equity could have a slower start while commodity prices are set to decline. In the current landscape, adaptability emerges as a key attribute for investors navigating the nuances of each market segment.

Like getting this newsletter? For unlimited access to over one million charts, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com