🤖 $110M Robotic Surgery Funding. Solar Index Down 42%.

Impact Capital Markets #34 looks at our Solar Energy stock index, major impact deals, M&A, and upcoming economic releases.

Kia ora 🏔️

📉 Today's Global Economic Update: Canada reported a 2.9% Year-on-Year inflation rate for January, down from 3.4% in December, driven by lower transport costs. Shelter prices, a factor influencing the Bank of Canada's interest rate decisions, saw an uptick, however, potentially delaying future rate cuts.

🤖 Deal of the Day: Medical Microinstruments, a developer of medical robotic systems, raised $110M to commercialize its surgical robotics platform.

What's New?

- 🌞 Solar Energy. Solar index down 42%

- 💰 Funding. Medical robotics, virtual care, decarbonization + more

- 💼 M&A. Cold storage & digital health

- 📅 Economics. Europe inflation data, US GDP data + more

For unlimited access to more deals and economic updates, request a demo

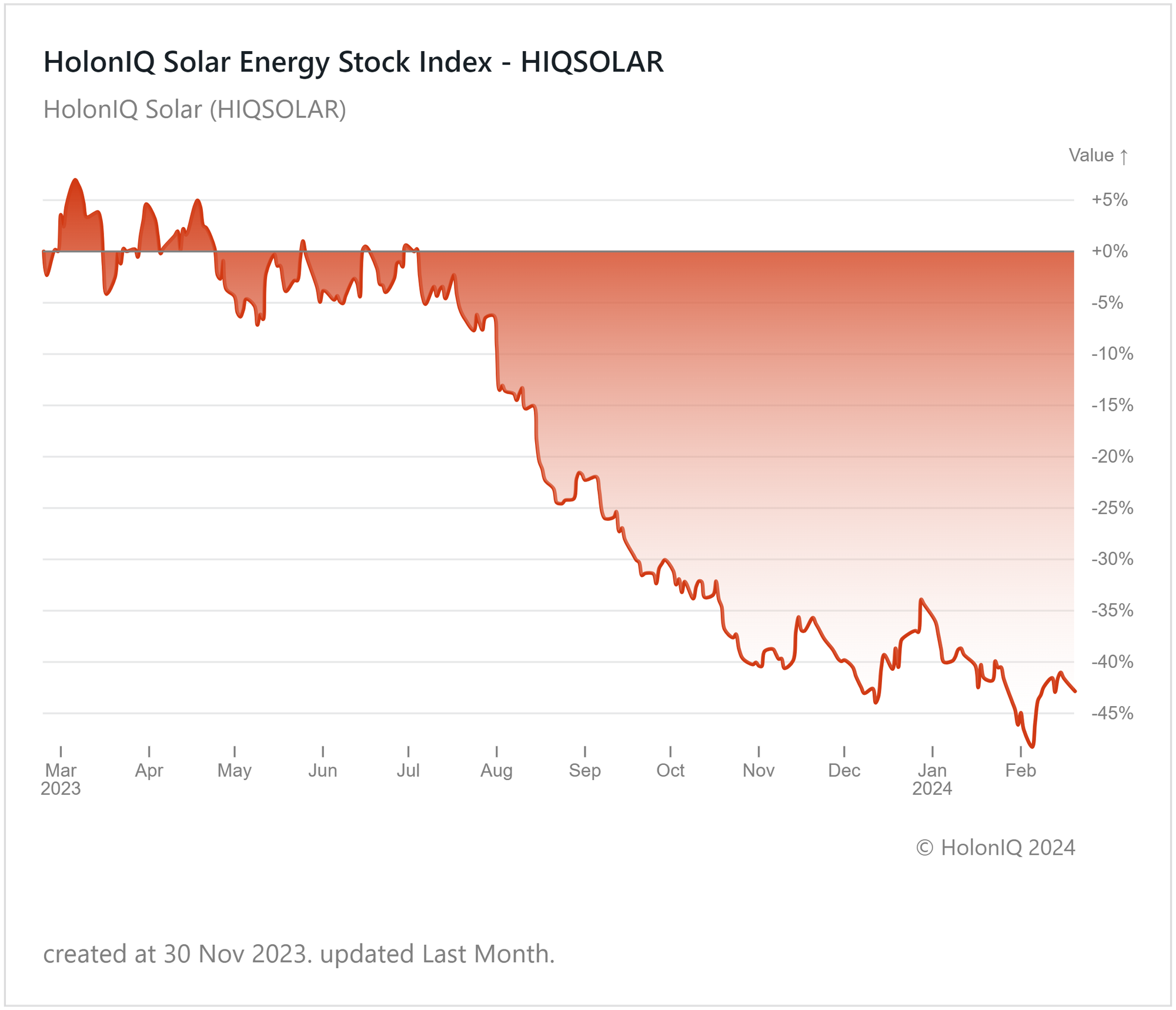

🌞 Solar Energy Index down 42%

HolonIQ’s Solar Index has seen a decline since July 2023, dropping by 42% over the last 12 months. Key stocks in the index have contributed to this downturn, with Enphase Energy (MCap: US$ 17B) falling by 38% YoY and First Solar (MCap: US$ 16B) by 8%. Although the solar industry experienced a notable increase in installations, reaching record levels in 2023, solar stocks have seen consistent declines since 2Q 2023.

The decline is a result of the high interest environment driving up project costs and, in turn, affecting profitability. Increases in interest rates typically result in higher generation costs for solar and wind power compared to those for natural gas plants.

💰 Funding

🤖 Medical Microinstruments, an Italian medical robotics company, raised a $110M Series C from Fidelity Management & Research Company to commercialize 'Symani Surgical System', its surgical robotics platform.

💻 Fabric, a New York-based health tech company, raised a $60M Series A from General Catalyst to grow its care enablement system and advance AI capabilities.

🩺 HealthSnap, a Florida-based virtual care management platform provider for chronic disease management, raised a $25M Series B from Sands Capital to grow its national clinical team and accelerate its product roadmap.

🌍 AtmosZero, a Colorado-based company focused on decarbonizing steam, raised a $21M Series A from Engine Ventures and 2150 to expand reach in Europe.

🧠 Blackbird Health, a Pennsylvania-based youth mental health provider focusing on neuroscience, raised a $17M Series A from Define Ventures to expand access to its technology-backed youth mental health model.

🎓 Empowerly, a California-based data-driven education technology company, raised a $15M Series A from Conductive Ventures to continue expanding its college counseling services.

🔬 Insamo, a California-based cyclic peptide biotechnology company, raised a $12M Seed to expand operations.

🚗 Altilium Clean Technology, a UK-based cleantech group, raised a $9.4M Series A from SQM Lithium Ventures to accelerate the zero-carbon energy transition in the UK and Europe.

💉 Tagomics, a UK-based platform developer for disease insight and diagnosis, raised a $8.4M Seed from Calculus Capital to accelerate its R&D.

📚 ZipLines Education, a California-based education technology company, raised a $6.4M Series A from Jackson Square Ventures to serve more students with proprietary technology products.

💼 M&A

❄️ Kinzie Capital Partners, an Illinois-based private equity firm, acquired Arctic Industries, a Florida-based company specializing in temperature control and cold storage solutions.

🩺 Aptar Digital Health, a digital health solutions company based in New York, has acquired Healint, a digital health company based in California known for its virtual clinical studies.

💊 DarioHealth Corp, a New York-based digital therapeutics company, acquired Twill, a health technology firm focused on mental health and wellbeing.

📅 Economic Calendar

Europe inflation data, US GDP data + more

Thursday, February 22nd 2024

🇺🇸 US FOMC Minutes

🇩🇪 Germany HCOB Manufacturing PMI (Preliminary), February

Friday, February 23rd 2024

🇩🇪 Germany Ifo Business Climate, February

Tuesday, February 27th 2024

🇯🇵 Japan Inflation Data, January

🇩🇪 Germany GfK Consumer Confidence, March

🇺🇸 US Durable Goods Orders Data, January

Wednesday, February 28th 2024

Thursday, February 29th 2024

🇫🇷 France Inflation Data (Preliminary), February

🇮🇳 India GDP Data, Q4

🇩🇪 Germany Inflation Data (Preliminary), February

🇨🇦 Canada GDP Data, Q4

🇺🇸 US Core PCE Price Index Data, January

🇺🇸 US Personal Income & Spending Data, January

Friday, March 01st 2024

🇨🇳 China NBS & Caixin Manufacturing PMI (Preliminary), February

🇯🇵 Japan Consumer Confidence, February

🇪🇦 Euro Area Inflation Data (Flash), February

🇮🇹 Italy GDP Data, 2024

🇮🇹 Italy Inflation Data (Preliminary), February

🇮🇹 Italy Government Budget, 2023

🇺🇸 US ISM Manufacturing PMI (Preliminary), February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com