🔬 $100M+ Biotech Funding. EdTech Index Up 12%.

Impact Capital Markets #83 looks at our EdTech stock index, major impact deals, M&A, and upcoming economic releases.

Ciao 🍕

📈 Today's Global Economic Update: Germany's GDP data released yesterday showed a 0.2% growth over the previous quarter, surpassing expectations. This growth came mainly from increased construction investments and exports, although household spending decreased.

🔬 Deal of the Day: Enlaza Therapeutics, a California-based biotechnology research company, raised a $100M Series A to develop its proprietary protein technologies.

What's New?

🌊 EdTech. EdTech index ends 3M flat, Up 12% LTM

💰 Funding. Network detection, biotech, climate risk solutions + more

💼 M&A. Biopharmaceuticals & healthcare services

📅 Economics. UK GDP, China inflation, employment data + more

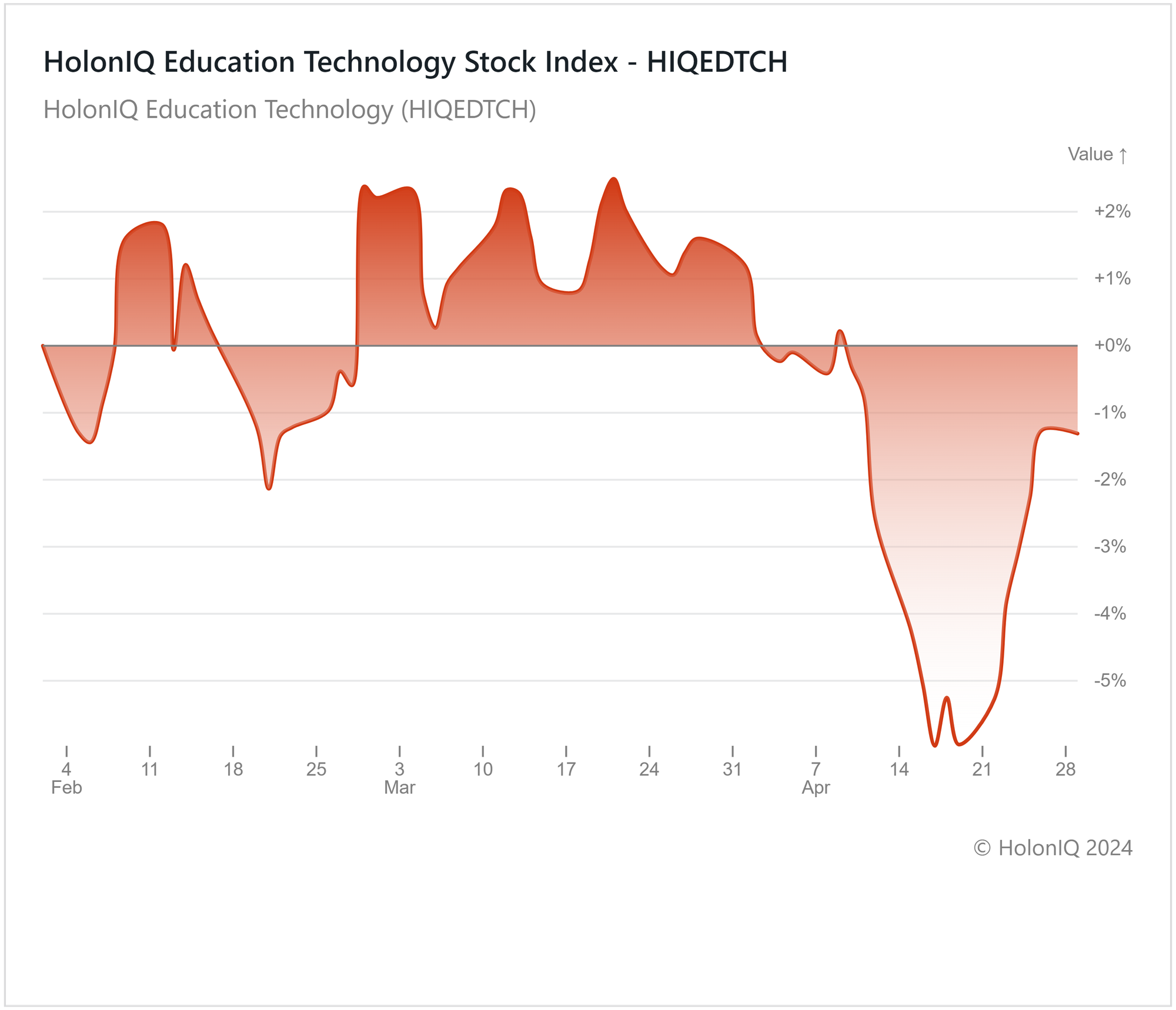

🧑💻 EdTech Index Ends 3M Flat, Up 12% LTM

HolonIQ’s EdTech index experienced steady growth in the second half of 2023, reaching 20%+ gains towards year-end. Over the past three months, index performance has, on average, been flat, closing at a 1% decline, with yearly gains standing at 12%. Free and open-source generative AI continues to challenge traditional EdTech which has led to some negative market sentiment. Large companies are striving to enhance these technologies, while smaller companies are struggling to keep pace, leading to volatility in the index.

Informa (13B MCap), Duolingo ($9B MCap), and Pearson ($8B MCap), among the largest stocks within the index (by market cap), delivered returns of 1.7%, 28%, and 1.2%, respectively. The companies are among EdTech firms launching AI and advanced immersive technologies to harness its potential. Pearson recently launched generative AI study tools in its academic study material. Duolingo made several product innovations, launched Math and Music courses, and used generative AI to develop new features and lesson types that enable more conversational and listening practice. Chegg (0.5B MCap), introduced an AI-powered learning platform built on OpenAI's GPT-4 model, providing a conversational learning companion. Amid these positives, the upcoming implementation of the EU's new AI regulations may pose fresh hurdles for AI EdTech, potentially dampening the performance of the index.

💰 Funding

🌐 Corelight, a California-based open network detection and response (NDR) company, raised a $150M Series E from Accel to accelerate its AI-driven security innovation.

🔬 Enlaza Therapeutics, a California-based biotechnology research company, raised a $100M Series A from Life Sciences group to further develop its protein technologies.

🌍 Arbol, a New York-based climate risk solution provider, raised a $60M Series B from Giant Ventures and Opera Tech Ventures to support its expansion into agriculture and renewable energy.

💻 Elisity, a California-based micro-segmentation company, raised a $37M Series B from Insight Partners to expand its platform's AI capabilities.

📰 Beehiiv, a New York-based email newsletter platform provider, raised a $33M Series B from NEA to enhance their engineering and support teams.

🧬 Qlaris Bio, a Massachusetts-based clinical-stage biotechnology company, raised a $24M Series B from Canaan and New Leaf Venture Partners to support their clinical developments.

👩⚕️ Vitestro, a Dutch medical technology company, raised a $22M Series B from Sonder Capital and NYBC Ventures to speed up commercialization for its blood-drawing robotic device.

💼 M&A

💊 Harmony Biosciences, a Pennsylvania-based pharmaceutical company, acquired Epygenix Therapeutics, a New Jersey-based biopharmaceutical company.

🏥 Manipal Hospitals, an Indian healthcare provider, signed a definitive agreement to acquire 87% stake in Medica Synergie, a hospital chain in India.

📅 Economic Calendar

UK GDP, China Inflation, Employment Data, Balance of Trade + More

Thursday, May 2nd 2024

🇨🇦 Canada Balance of Trade Data, March

🇯🇵 Japan Consumer Confidence Index, April

Friday, May 3rd 2024

🇺🇸 US Employment Data, April

🇺🇸 US ISM Services PMI, April

Tuesday, May 7th 2024

🇦🇺 Australia RBA Interest Decision

🇩🇪 Germany Balance of Trade Data, March

🇨🇦 Canada Ivey PMI s.a, April

Wednesday, May 8th 2024

🇨🇳 China Balance of Trade Data, April

Thursday, May 9th 2024

Friday, May 10th 2024

🇬🇧 UK GDP Data, Q1

🇨🇦 Canada Employment Data, April

🇺🇸 US Michigan Consumer Sentiment (Preliminary), May

🇨🇳 China Inflation Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com